Some federal contractors couldn't get paid. Companies that wanted Small Business Administration -backed loans had to wait longer for approvals. HIRING In January, small businesses added 106,000 jobs, according to payroll provider ADP. But optimism about a small business hiring boom dissipated as the number of new jobs fell in February and then averaged nearly 70,000 through October. Owners said they weren't planning to add workers because they didn't have the sales to justify the expense, or they didn't need to hire to grow, according to an American Express survey back in the spring. Uncertainty about health care also made them wary. Through most of the year owners stuck to those plans, but near then end of the 2013 there was a glimmer of hope. ADP reported that small businesses created 102,000 new jobs in November. More insight that could bode well for small business hiring next year, came from a Bank of America survey. Thirty-one percent of owners questioned in the fall said they planned to hire, and 56 percent of those owners said they needed employees to boost business in 2014. That could be good news for the broader economy because more than 99 percent of U.S.

Some federal contractors couldn't get paid. Companies that wanted Small Business Administration -backed loans had to wait longer for approvals. HIRING In January, small businesses added 106,000 jobs, according to payroll provider ADP. But optimism about a small business hiring boom dissipated as the number of new jobs fell in February and then averaged nearly 70,000 through October. Owners said they weren't planning to add workers because they didn't have the sales to justify the expense, or they didn't need to hire to grow, according to an American Express survey back in the spring. Uncertainty about health care also made them wary. Through most of the year owners stuck to those plans, but near then end of the 2013 there was a glimmer of hope. ADP reported that small businesses created 102,000 new jobs in November. More insight that could bode well for small business hiring next year, came from a Bank of America survey. Thirty-one percent of owners questioned in the fall said they planned to hire, and 56 percent of those owners said they needed employees to boost business in 2014. That could be good news for the broader economy because more than 99 percent of U.S.

5 Small Business Mistakes To Avoid In 2014

Prices start pretty low for this kind of marketing, so now is a good time to look into it. 3. Being chained to your computer:In some ways, its fantastic how rarely a small business owner feels a need to leave their computer to do business. Tasks that used to mean travel (whether its just to the next room or across the world) now can happen without ever having to get up from your desk. That is undeniably pretty cool. But at this point, maybe its time to stop being amazed at the coolness and convenience of modern business technology, and start actually examining which old-school methods are worth holding onto. This tech audit will surely look different for every small business, but weve found this is a good bottom line to aim for: do everything you can to preserve face-to-face interactions. Just trust us. Any time its possible, suggest a coffee or lunch meeting instead of volleying emails all day. It can end up being a time saver, not to mention the invaluable forging of relationships that result from personal contact especially during a time when its increasingly rare. Simply meeting in person is enough to make you stand out and stick in someones mind. Be that person. 4. Blaming the government for anything:Yes, Obamacare . Yes, government shutdown. Yes, fiscal cliff. Listen, the government has undoubtedly been active in the past year in a lot of ways that are impactful for small businesses. Were not saying these issuesdontmatter to you and your business.

Prices start pretty low for this kind of marketing, so now is a good time to look into it. 3. Being chained to your computer:In some ways, its fantastic how rarely a small business owner feels a need to leave their computer to do business. Tasks that used to mean travel (whether its just to the next room or across the world) now can happen without ever having to get up from your desk. That is undeniably pretty cool. But at this point, maybe its time to stop being amazed at the coolness and convenience of modern business technology, and start actually examining which old-school methods are worth holding onto. This tech audit will surely look different for every small business, but weve found this is a good bottom line to aim for: do everything you can to preserve face-to-face interactions. Just trust us. Any time its possible, suggest a coffee or lunch meeting instead of volleying emails all day. It can end up being a time saver, not to mention the invaluable forging of relationships that result from personal contact especially during a time when its increasingly rare. Simply meeting in person is enough to make you stand out and stick in someones mind. Be that person. 4. Blaming the government for anything:Yes, Obamacare . Yes, government shutdown. Yes, fiscal cliff. Listen, the government has undoubtedly been active in the past year in a lot of ways that are impactful for small businesses. Were not saying these issuesdontmatter to you and your business.

13 Small Business Tasks to Complete By the End of 2013

Build Your 2014 Map Dont forget the big picture while youre working on the smaller tasks at hand. You need a vision for your future. Where are you going in 2014 and what are your goals? Hold Annual Reviews Its the perfect time to discuss performance with your employees and let them know how they can help the company run at its peak performance. Take time to praise them and listen to their concerns one on one. Hold an Open Forum Your employees work with your customers day in and day out. Thats why theyre often the best people to help suggest ways to make your customers happier. Hold a year-end forum that encourages your employees to share any ideas they have. This is one of many ways to keep your employees happy and show them that you value their input. Review Your Insurance Policies Oftentimes insurance policies are drawn up and then forgotten about until theyre needed. At that time, business owners personal information management may realize that they dont have adequate coverage. Go ahead and review your policies with care it could potentially save you a lot of money. Touch Base with Your Best Customers Let your customers know that you appreciate their business. Take some time to find out if theres anything else you can do to improve or help improve their experience with your business. Send a letter or survey out its a simple way to show you care about your customers needs and encourage constructive feedback. Check Out Your Business Cards Youre probably handing out your business cards to a bevy of people. Review your business cards to make sure all of your information is accurate and up-to-date and that the layout matches that of your website. Look Over Your Budget The reason you prepare a budget is to compare it to your performance and see how youre doing. Check and see what you did right and where you can improve. The power of a budget is in the analysis.

Build Your 2014 Map Dont forget the big picture while youre working on the smaller tasks at hand. You need a vision for your future. Where are you going in 2014 and what are your goals? Hold Annual Reviews Its the perfect time to discuss performance with your employees and let them know how they can help the company run at its peak performance. Take time to praise them and listen to their concerns one on one. Hold an Open Forum Your employees work with your customers day in and day out. Thats why theyre often the best people to help suggest ways to make your customers happier. Hold a year-end forum that encourages your employees to share any ideas they have. This is one of many ways to keep your employees happy and show them that you value their input. Review Your Insurance Policies Oftentimes insurance policies are drawn up and then forgotten about until theyre needed. At that time, business owners personal information management may realize that they dont have adequate coverage. Go ahead and review your policies with care it could potentially save you a lot of money. Touch Base with Your Best Customers Let your customers know that you appreciate their business. Take some time to find out if theres anything else you can do to improve or help improve their experience with your business. Send a letter or survey out its a simple way to show you care about your customers needs and encourage constructive feedback. Check Out Your Business Cards Youre probably handing out your business cards to a bevy of people. Review your business cards to make sure all of your information is accurate and up-to-date and that the layout matches that of your website. Look Over Your Budget The reason you prepare a budget is to compare it to your performance and see how youre doing. Check and see what you did right and where you can improve. The power of a budget is in the analysis.

RBS brings in lawyers to review treatment of ailing small firms By Matt Scuffham Email Print A logo at a Royal Bank of Scotland (RBS) branch is seen in the City of London March 6, 2013. Credit: Reuters/Toby Melville Critic of RBS business lending had own complaint against bank Mon, Nov 25 2013 LONDON (Reuters) - Royal Bank of Scotland (RBS.L) has appointed law firm Clifford Chance to conduct an inquiry into the treatment received by small business customers in financial distress, responding to suggestions it closed down viable businesses too quickly. The move comes after an independent report by former Bank of England deputy governor Andrew Large, which was commissioned by RBS, recommended the bank look into concerns over its treatment of struggling small businesses. RBS has also been accused by government adviser Lawrence Tomlinson of pushing struggling small firms into its "turnaround" unit, so it can charge higher fees (on the basis they have defaulted) and take control of their assets. "To ensure our customers can have full confidence in our commitment to them, I have asked Clifford Chance to conduct an inquiry into this matter, reporting back to me in the new year," RBS Chief Executive Ross McEwan said in a letter to Large on Monday. Large told Reuters that Britain's financial regulator was almost certain to take action in relation to the accusations if they are found to be true, adding the bank had taken the findings of his report "very seriously". "I merely looked at the assertions themselves which were clearly very serious. If they are found to be true it's almost certain the regulator will take quite an interest in it," he said. Business Secretary Vince Cable demanded an urgent response from Britain's financial regulators and from RBS, 82 percent owned by taxpayers following a 45 billion pounds ($73 billion) government rescue during the 2008 financial crisis. Asked on BBC radio if a criminal investigation should be launched he said: "That's for the regulators and the police to establish, whether there is a case. The authorities need to establish whether there is something worse than unethical behavior actually going on here". The regulator has so far declined to comment. Tomlinson, a businessman hired as an adviser by Cable's department in April, said RBS had engineered businesses into default in order to move them into its so-called Global Restructuring Group (GRG). Tomlinson said that maneuver enabled the bank to generate revenue through higher fees and the purchase of devalued assets by its property division, West Register. Britain's Federation of Small Businesses said: "The regulators need to investigate the findings of both the Tomlinson and Sir Andrew Large reports and swiftly address any issues raised to restore trust in the banks." SIGNIFICANT STRESS Yet the scrutiny of GRG could expose a contradiction in what RBS had been asked to do following its bailout - stabilize its finances at the same time as boosting support for small firms. RBS said GRG had successfully turned around most of the businesses it worked with. "In all cases RBS is working with customers at a time of significant stress in their lives. Not all businesses that encounter serious financial trouble can be saved," it said. GRG is run by Derek Sach, a former executive of British private equity firm 3i Group (III.L). It is part of the bank's non-core division, run by Rory Cullinan, front runner to become head of RBS's internal "bad bank", which is being created after the government decided against breaking the bank up. Cullinan has overseen a reduction in the group's non-core loans from a peak of 258 billion pounds to around 40 billion. The latest RBS allegations come as banks in Britain and beyond continue to be the focus of public disquiet. Tapping in to popular mistrust of the financial sector, the government has ordered Britain's financial watchdog to probe Co-op Bank after the arrest of its former chairman as part of an investigation into the supply of illegal drugs. Tomlinson was hired by the business department in April as an "entrepreneur-in-residence" to help address the needs of small and medium-sized businesses". He runs LNT Group, based in the north of England, which has annual revenue of 100 million pounds and interests from construction to care homes. ($1 = 0.6178 British pounds) (Additional reporting by William James; Editing by David Holmes and Mark Potter) FILED UNDER:

RBS brings in lawyers to review treatment of ailing small firms By Matt Scuffham Email Print A logo at a Royal Bank of Scotland (RBS) branch is seen in the City of London March 6, 2013. Credit: Reuters/Toby Melville Critic of RBS business lending had own complaint against bank Mon, Nov 25 2013 LONDON (Reuters) - Royal Bank of Scotland (RBS.L) has appointed law firm Clifford Chance to conduct an inquiry into the treatment received by small business customers in financial distress, responding to suggestions it closed down viable businesses too quickly. The move comes after an independent report by former Bank of England deputy governor Andrew Large, which was commissioned by RBS, recommended the bank look into concerns over its treatment of struggling small businesses. RBS has also been accused by government adviser Lawrence Tomlinson of pushing struggling small firms into its "turnaround" unit, so it can charge higher fees (on the basis they have defaulted) and take control of their assets. "To ensure our customers can have full confidence in our commitment to them, I have asked Clifford Chance to conduct an inquiry into this matter, reporting back to me in the new year," RBS Chief Executive Ross McEwan said in a letter to Large on Monday. Large told Reuters that Britain's financial regulator was almost certain to take action in relation to the accusations if they are found to be true, adding the bank had taken the findings of his report "very seriously". "I merely looked at the assertions themselves which were clearly very serious. If they are found to be true it's almost certain the regulator will take quite an interest in it," he said. Business Secretary Vince Cable demanded an urgent response from Britain's financial regulators and from RBS, 82 percent owned by taxpayers following a 45 billion pounds ($73 billion) government rescue during the 2008 financial crisis. Asked on BBC radio if a criminal investigation should be launched he said: "That's for the regulators and the police to establish, whether there is a case. The authorities need to establish whether there is something worse than unethical behavior actually going on here". The regulator has so far declined to comment. Tomlinson, a businessman hired as an adviser by Cable's department in April, said RBS had engineered businesses into default in order to move them into its so-called Global Restructuring Group (GRG). Tomlinson said that maneuver enabled the bank to generate revenue through higher fees and the purchase of devalued assets by its property division, West Register. Britain's Federation of Small Businesses said: "The regulators need to investigate the findings of both the Tomlinson and Sir Andrew Large reports and swiftly address any issues raised to restore trust in the banks." SIGNIFICANT STRESS Yet the scrutiny of GRG could expose a contradiction in what RBS had been asked to do following its bailout - stabilize its finances at the same time as boosting support for small firms. RBS said GRG had successfully turned around most of the businesses it worked with. "In all cases RBS is working with customers at a time of significant stress in their lives. Not all businesses that encounter serious financial trouble can be saved," it said. GRG is run by Derek Sach, a former executive of British private equity firm 3i Group (III.L). It is part of the bank's non-core division, run by Rory Cullinan, front runner to become head of RBS's internal "bad bank", which is being created after the government decided against breaking the bank up. Cullinan has overseen a reduction in the group's non-core loans from a peak of 258 billion pounds to around 40 billion. The latest RBS allegations come as banks in Britain and beyond continue to be the focus of public disquiet. Tapping in to popular mistrust of the financial sector, the government has ordered Britain's financial watchdog to probe Co-op Bank after the arrest of its former chairman as part of an investigation into the supply of illegal drugs. Tomlinson was hired by the business department in April as an "entrepreneur-in-residence" to help address the needs of small and medium-sized businesses". He runs LNT Group, based in the north of England, which has annual revenue of 100 million pounds and interests from construction to care homes. ($1 = 0.6178 British pounds) (Additional reporting by William James; Editing by David Holmes and Mark Potter) FILED UNDER:

This was determined by analysts from renowned IT

This was determined by analysts from renowned IT  Customers need only to enter the date, payees name and amount payable to the payee. This check writer will automatically convert numbers to words. Customers can write and print a check with just a few clicks. New customers can download and try this software free at http://www.halfpricesoft.com/check_printing_software_download.asp In addition to its new compatibility with QuickBooks online version, this check printing software also includes many more features that make check printing easier, faster and less costly for small businesses: Add a company logo and other customization design features for a professional, corporate look to company checks Easy to use and learn, even for people who dont have an accounting or IT background No limit to the number of accounts that can be used Write an unlimited number of checks Prints MICR characters accepted by most banks (for use with laser printers) no need to order expensive checks pre-printed with bank information Use blank check stock or pre-printed checks in check-on-top, check-in-middle, or check-on-bottom formats Include signature image on checks to save time signing checks Customization report features that are easy to use Save time by printing multiple checks with one click Export and import of check data for use with ezTimeSheet, Excel file, QuickBooks, Microsoft Money, and other accounting software. Customers can make sure the check software is right for their company without obligation before purchasing.

Customers need only to enter the date, payees name and amount payable to the payee. This check writer will automatically convert numbers to words. Customers can write and print a check with just a few clicks. New customers can download and try this software free at http://www.halfpricesoft.com/check_printing_software_download.asp In addition to its new compatibility with QuickBooks online version, this check printing software also includes many more features that make check printing easier, faster and less costly for small businesses: Add a company logo and other customization design features for a professional, corporate look to company checks Easy to use and learn, even for people who dont have an accounting or IT background No limit to the number of accounts that can be used Write an unlimited number of checks Prints MICR characters accepted by most banks (for use with laser printers) no need to order expensive checks pre-printed with bank information Use blank check stock or pre-printed checks in check-on-top, check-in-middle, or check-on-bottom formats Include signature image on checks to save time signing checks Customization report features that are easy to use Save time by printing multiple checks with one click Export and import of check data for use with ezTimeSheet, Excel file, QuickBooks, Microsoft Money, and other accounting software. Customers can make sure the check software is right for their company without obligation before purchasing. BSI Financial selected Docunym for the solutions ability to streamline document management and provide secure access for their clients. The company has saved both

BSI Financial selected Docunym for the solutions ability to streamline document management and provide secure access for their clients. The company has saved both  U.S. small business hiring up despite government shutdown WASHINGTON Wed Nov 6, 2013 12:07pm EST Email Print A job seeker (L) makes her pitch to a recruiter at the Colorado Hospital Association health care career fair in Denver April 9, 2013. Credit: Reuters/Rick Wilking WASHINGTON (Reuters) - U.S. small businesses stepped up hiring in October, despite uncertainty brought by a partial shutdown of the federal government, a survey showed on Wednesday. The National Federation of Independent Business said small business owners added an average of 0.11 workers per firm last month, reversing September's decline. "In spite of the government shut-down, employment rose among small firms in October," the NFIB said in a statement. The increase in hiring by small businesses is an encouraging sign for the economy amid estimates that the 16-day government shutdown could have sliced off as much as 0.6 percentage point from fourth quarter gross domestic product (GDP) growth. The NFIB's findings come ahead of the release on Friday of the government's comprehensive employment report for October, which is expected to show that the shutdown held back hiring. Non-farm payrolls are forecast to have risen by only 125,000 jobs last month, according to a Reuters survey of economists, down from an increase of 148,000 in September. The NFIB survey found that 12 percent of small business owners throughout the country added an average of 3.5 workers per firm over the past few months. That was a slight improvement from prior periods. About nine percent of businesses, the smallest share since 2006, reported laying off an average of 2.8 workers. "Reports of workforce reductions have reached sub-normal levels. But owners report sub-par levels of hiring, so job growth remains anemic," the NFIB said. There was a slight increase in the share of business owners reporting hard-to-fill job openings. There was also a modest increase in the number of employers hiring temporary workers. Temporary employment is seen as a harbinger of future hiring, but could also indicate reluctance by employers to take on full-time workers because of uncertainty related to health care regulations and the economic outlook. (Reporting by Lucia Mutikani; Editing by Meredith Mazzilli) FILED UNDER:

U.S. small business hiring up despite government shutdown WASHINGTON Wed Nov 6, 2013 12:07pm EST Email Print A job seeker (L) makes her pitch to a recruiter at the Colorado Hospital Association health care career fair in Denver April 9, 2013. Credit: Reuters/Rick Wilking WASHINGTON (Reuters) - U.S. small businesses stepped up hiring in October, despite uncertainty brought by a partial shutdown of the federal government, a survey showed on Wednesday. The National Federation of Independent Business said small business owners added an average of 0.11 workers per firm last month, reversing September's decline. "In spite of the government shut-down, employment rose among small firms in October," the NFIB said in a statement. The increase in hiring by small businesses is an encouraging sign for the economy amid estimates that the 16-day government shutdown could have sliced off as much as 0.6 percentage point from fourth quarter gross domestic product (GDP) growth. The NFIB's findings come ahead of the release on Friday of the government's comprehensive employment report for October, which is expected to show that the shutdown held back hiring. Non-farm payrolls are forecast to have risen by only 125,000 jobs last month, according to a Reuters survey of economists, down from an increase of 148,000 in September. The NFIB survey found that 12 percent of small business owners throughout the country added an average of 3.5 workers per firm over the past few months. That was a slight improvement from prior periods. About nine percent of businesses, the smallest share since 2006, reported laying off an average of 2.8 workers. "Reports of workforce reductions have reached sub-normal levels. But owners report sub-par levels of hiring, so job growth remains anemic," the NFIB said. There was a slight increase in the share of business owners reporting hard-to-fill job openings. There was also a modest increase in the number of employers hiring temporary workers. Temporary employment is seen as a harbinger of future hiring, but could also indicate reluctance by employers to take on full-time workers because of uncertainty related to health care regulations and the economic outlook. (Reporting by Lucia Mutikani; Editing by Meredith Mazzilli) FILED UNDER:

U.S. delays online health insurance enrollment for small businesses By David Morgan Email Print A man looks over the Affordable Care Act (commonly known as Obamacare) signup page on the HealthCare.gov website in New York in this October 2, 2013 photo illustration. Credit: Reuters/Mike Segar WASHINGTON (Reuters) - The Obama administration on Wednesday postponed online health insurance enrollment for small businesses under Obamacare for one year, a move quickly seized upon by critics as proof the healthcare reform law should be delayed or replaced. The announcement affecting businesses with 50 or fewer workers was the latest in a series of delays that have diminished the scope of President Barack Obama's landmark healthcare law, the Patient Protection and Affordable Care Act. Administration officials said the delay stemmed from the need to focus on fixing HealthCare.gov by a Saturday deadline for having the enrollment website working smoothly for most visitors from the 36 states it serves. The online market portal has been hobbled by technical problems since its launch on October 1, frustrating millions of Americans seeking information on new individual health coverage required under the law. "It was important for us to prioritize the functionality that would enable consumers individually to shop and enroll online in coverage," said Julie Bataille, communications director for the Centers for Medicare and Medicaid Services (CMS), the federal agency responsible for the Obamacare marketplaces. Online enrollment for small businesses was originally expected to be available on October 1. Administration officials say they now plan to offer web-based enrollment services by November 2014. Republicans, who want to repeal or fundamentally alter the law, pounced on the fact that the announcement came on the eve of the Thanksgiving Day holiday when many Americans are distracted by travel and family activities. Last summer, the administration delayed the law's coverage mandate for larger businesses just before the July 4 Independence Day holiday. "The administration is doing its best to bury the latest confirmation that this law was not ready for prime time," Representative Fred Upton, chairman of the House Energy and Commerce Committee, said in a statement. The National Federation of Independent Business, a trade group that asked the U.S. Supreme Court to overturn Obamacare in 2012, blasted the announcement as a new burden for employers. "It probably matters little to people in Washington that the failure to get the small business exchanges online adds yet another onerous paperwork requirement for job creators," the organization said. Employers seeking coverage through the federal Small Business Health Options Program, or SHOP, marketplace will be able to enroll off-line through insurance companies, agents and brokers, the administration said. Until now, SHOP enrollment had been available only through paper applications. Administration officials said insurance agents and brokers already serve many small businesses, so the avenue should be familiar to those who want Obamacare coverage for their employees. Businesses with fewer than 50 employees are not required to offer insurance to their workers and have a one-year enrollment period, versus six months for individuals. (Additional reporting by Roberta Rampton in Washington and Lewis Krauskopf in New York; Editing by Michele Gershberg, David Brunnstrom and Philip Barbara) FILED UNDER:

U.S. delays online health insurance enrollment for small businesses By David Morgan Email Print A man looks over the Affordable Care Act (commonly known as Obamacare) signup page on the HealthCare.gov website in New York in this October 2, 2013 photo illustration. Credit: Reuters/Mike Segar WASHINGTON (Reuters) - The Obama administration on Wednesday postponed online health insurance enrollment for small businesses under Obamacare for one year, a move quickly seized upon by critics as proof the healthcare reform law should be delayed or replaced. The announcement affecting businesses with 50 or fewer workers was the latest in a series of delays that have diminished the scope of President Barack Obama's landmark healthcare law, the Patient Protection and Affordable Care Act. Administration officials said the delay stemmed from the need to focus on fixing HealthCare.gov by a Saturday deadline for having the enrollment website working smoothly for most visitors from the 36 states it serves. The online market portal has been hobbled by technical problems since its launch on October 1, frustrating millions of Americans seeking information on new individual health coverage required under the law. "It was important for us to prioritize the functionality that would enable consumers individually to shop and enroll online in coverage," said Julie Bataille, communications director for the Centers for Medicare and Medicaid Services (CMS), the federal agency responsible for the Obamacare marketplaces. Online enrollment for small businesses was originally expected to be available on October 1. Administration officials say they now plan to offer web-based enrollment services by November 2014. Republicans, who want to repeal or fundamentally alter the law, pounced on the fact that the announcement came on the eve of the Thanksgiving Day holiday when many Americans are distracted by travel and family activities. Last summer, the administration delayed the law's coverage mandate for larger businesses just before the July 4 Independence Day holiday. "The administration is doing its best to bury the latest confirmation that this law was not ready for prime time," Representative Fred Upton, chairman of the House Energy and Commerce Committee, said in a statement. The National Federation of Independent Business, a trade group that asked the U.S. Supreme Court to overturn Obamacare in 2012, blasted the announcement as a new burden for employers. "It probably matters little to people in Washington that the failure to get the small business exchanges online adds yet another onerous paperwork requirement for job creators," the organization said. Employers seeking coverage through the federal Small Business Health Options Program, or SHOP, marketplace will be able to enroll off-line through insurance companies, agents and brokers, the administration said. Until now, SHOP enrollment had been available only through paper applications. Administration officials said insurance agents and brokers already serve many small businesses, so the avenue should be familiar to those who want Obamacare coverage for their employees. Businesses with fewer than 50 employees are not required to offer insurance to their workers and have a one-year enrollment period, versus six months for individuals. (Additional reporting by Roberta Rampton in Washington and Lewis Krauskopf in New York; Editing by Michele Gershberg, David Brunnstrom and Philip Barbara) FILED UNDER:

Aims offers the highest levels of services in IT from

Aims offers the highest levels of services in IT from  IDC forecasts that the volume of digital data will grow 40 - 50 percent per year clearly indicating that Information Storage and Management will remain in vogue and a big focus area for CIOs across sectors. With new buzzwords emerging such as Software Defined Datacenters, integrated backup appliances etc. we believe that 2014, will continue to see these new trends gaining momentum. As cloud based storage, backup and disaster recovery become commonplace, managing and protecting data will also be a focus area for enterprises and SMBs. Below are the 2014 predictions for Storage and Information Management: Rise of SoCloMo Social media, cloud computing and mobility will continue to be disruptive and challenge businesses with an immense amount of information spread across various platforms including public clouds and mobile devices. With data levels rising, the amount of valuable information being stored in these platforms will rise causing SMBs to increase their focus on having a sound Information Management strategy in place and businesses will be tasked to discover new ways to not only protect their information, but also manage it. In the coming years, we will witness the effects of social media, cloud computing and mobility to play an important role in transforming the way Datacenters currently operate, which brings me to my next point. Evolution of Datacenters We, at Symantec, believe that 2014 will be the year where Software Defined Everything' will start taking shape with companies with trends such as Software Defined Storage and Software Defined Networking leading this charge. With the explosion of Information, we believe that SMBs will begin to rely more heavily on Datacenters. In order to increase overall efficiency, we will see the concept of Software Defined Datacenter, which virtualizes the server, network, and storage levels, gaining more prominence. SDDC will bring in a more efficient and centralized model of utilizing IT resources. As part of the Software Defined Datacenter, Software Defined Storage will also be regarded as a key development in the storage space, allowing increased flexibility in how SMBs can store information Software-defined storage has the potential to spellthe end of over-provisioning as storage can be allocated more accurately from a wider pool. It also frees organizations from the cost overheads associated with proprietary storage. Increased adoption of Cloud Storage Companies who use traditional storage have been put under pressure with increasing storage capacity requirements and costs impelled by data deluge forcing companies to now look at the cloud as more than just a buzzword. As a result, companies are increasingly warming up to the promise of deploying cloud storage in the enterprise to harness its benefits, i.e., flexibility, simplicity, fault tolerance. In Symantec's 2013 Avoiding the Hidden Costs of the Cloud survey we found that more than 90 percent of Enterprises in India are at least discussing cloud. In 2014, we believe that Cloud Storage will become seen as a more important requirement for SMBs to better manage their information. Integrated Backup Appliances We will see companies replacing their traditional solutions with integrated systems such as integrated backup appliances, to deal with the vast amount of information they have, which is only set to increase in 2014. Integrated backup appliances combine source and target deduplication, backup software, replication, snapshots, security and cloud integration in a single appliance and managed from a central location. In fact, we believe that integrated backup appliances are the answer to deal with the challenges of data deluge enterprises are facing today.

IDC forecasts that the volume of digital data will grow 40 - 50 percent per year clearly indicating that Information Storage and Management will remain in vogue and a big focus area for CIOs across sectors. With new buzzwords emerging such as Software Defined Datacenters, integrated backup appliances etc. we believe that 2014, will continue to see these new trends gaining momentum. As cloud based storage, backup and disaster recovery become commonplace, managing and protecting data will also be a focus area for enterprises and SMBs. Below are the 2014 predictions for Storage and Information Management: Rise of SoCloMo Social media, cloud computing and mobility will continue to be disruptive and challenge businesses with an immense amount of information spread across various platforms including public clouds and mobile devices. With data levels rising, the amount of valuable information being stored in these platforms will rise causing SMBs to increase their focus on having a sound Information Management strategy in place and businesses will be tasked to discover new ways to not only protect their information, but also manage it. In the coming years, we will witness the effects of social media, cloud computing and mobility to play an important role in transforming the way Datacenters currently operate, which brings me to my next point. Evolution of Datacenters We, at Symantec, believe that 2014 will be the year where Software Defined Everything' will start taking shape with companies with trends such as Software Defined Storage and Software Defined Networking leading this charge. With the explosion of Information, we believe that SMBs will begin to rely more heavily on Datacenters. In order to increase overall efficiency, we will see the concept of Software Defined Datacenter, which virtualizes the server, network, and storage levels, gaining more prominence. SDDC will bring in a more efficient and centralized model of utilizing IT resources. As part of the Software Defined Datacenter, Software Defined Storage will also be regarded as a key development in the storage space, allowing increased flexibility in how SMBs can store information Software-defined storage has the potential to spellthe end of over-provisioning as storage can be allocated more accurately from a wider pool. It also frees organizations from the cost overheads associated with proprietary storage. Increased adoption of Cloud Storage Companies who use traditional storage have been put under pressure with increasing storage capacity requirements and costs impelled by data deluge forcing companies to now look at the cloud as more than just a buzzword. As a result, companies are increasingly warming up to the promise of deploying cloud storage in the enterprise to harness its benefits, i.e., flexibility, simplicity, fault tolerance. In Symantec's 2013 Avoiding the Hidden Costs of the Cloud survey we found that more than 90 percent of Enterprises in India are at least discussing cloud. In 2014, we believe that Cloud Storage will become seen as a more important requirement for SMBs to better manage their information. Integrated Backup Appliances We will see companies replacing their traditional solutions with integrated systems such as integrated backup appliances, to deal with the vast amount of information they have, which is only set to increase in 2014. Integrated backup appliances combine source and target deduplication, backup software, replication, snapshots, security and cloud integration in a single appliance and managed from a central location. In fact, we believe that integrated backup appliances are the answer to deal with the challenges of data deluge enterprises are facing today. Candle maker Blyth rejects takeover offer from CVSL Fri Nov 15, 2013 4:16pm EST Email Print (Reuters) - Candle maker Blyth Inc (BTH.N) rejected an unsolicited acquisition proposal from direct seller CVSL Inc (CVSL.PK), saying the offer was not supported by committed financing and may leave it saddled with debt. CVSL last month proposed to acquire Blyth for $16.75 per share, or about $270 million. CVSL advisers indicated that the company did not have the capacity to raise more debt, Blyth said. Any debt raised to finance the deal would therefore be based on Blyth's leverage capacity, the company said in a statement. The offer also required the company to use its cash to repay existing debt and did not address its working capital needs, Blyth said. "Based on the Blyth board's initial comments, it is not clear to us that they have a full understanding of our proposal," Chairman of CVSL's investment committee John Rochon Jr. said in a statement later on Friday. The company said it would amplify its proposal to Blyth in due course. CVSL, formerly Computer Vision System Laboratories Corp, sells hand-crafted baskets and a line of products for the home, including pottery and cookware, through a network of independent sales representatives. Blyth has retained Wachtell, Lipton, Rosen and Katz as legal advisers and Jefferies LLC as financial advisers. Blyth's shares closed down 4 percent at $12.00 on the New York Stock Exchange on Friday. (Reporting by Aditi Shrivastava and Maria Ajit Thomas in Bangalore; Editing by Don Sebastian) FILED UNDER:

Candle maker Blyth rejects takeover offer from CVSL Fri Nov 15, 2013 4:16pm EST Email Print (Reuters) - Candle maker Blyth Inc (BTH.N) rejected an unsolicited acquisition proposal from direct seller CVSL Inc (CVSL.PK), saying the offer was not supported by committed financing and may leave it saddled with debt. CVSL last month proposed to acquire Blyth for $16.75 per share, or about $270 million. CVSL advisers indicated that the company did not have the capacity to raise more debt, Blyth said. Any debt raised to finance the deal would therefore be based on Blyth's leverage capacity, the company said in a statement. The offer also required the company to use its cash to repay existing debt and did not address its working capital needs, Blyth said. "Based on the Blyth board's initial comments, it is not clear to us that they have a full understanding of our proposal," Chairman of CVSL's investment committee John Rochon Jr. said in a statement later on Friday. The company said it would amplify its proposal to Blyth in due course. CVSL, formerly Computer Vision System Laboratories Corp, sells hand-crafted baskets and a line of products for the home, including pottery and cookware, through a network of independent sales representatives. Blyth has retained Wachtell, Lipton, Rosen and Katz as legal advisers and Jefferies LLC as financial advisers. Blyth's shares closed down 4 percent at $12.00 on the New York Stock Exchange on Friday. (Reporting by Aditi Shrivastava and Maria Ajit Thomas in Bangalore; Editing by Don Sebastian) FILED UNDER:

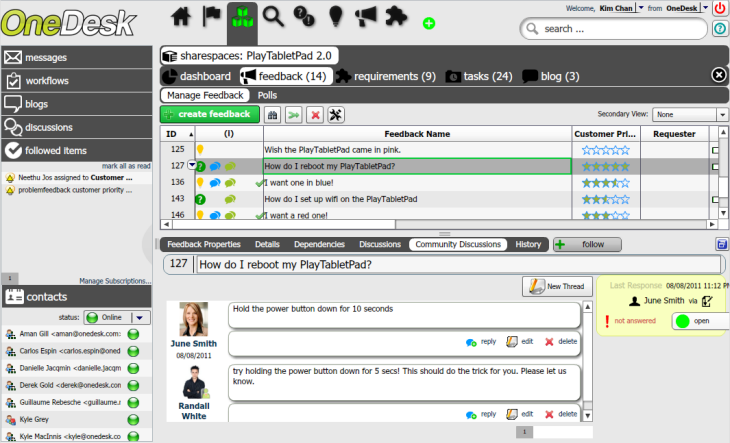

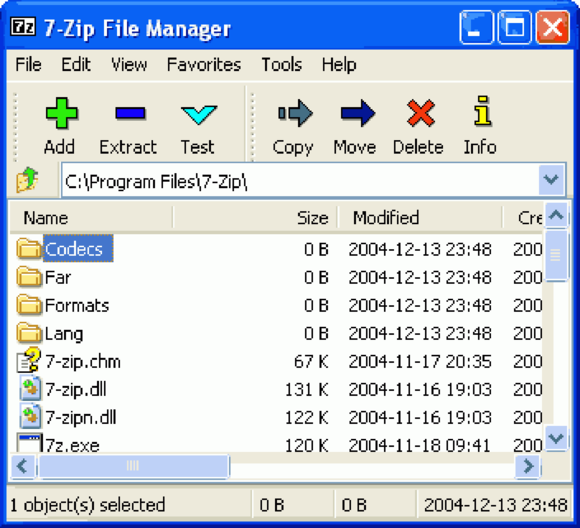

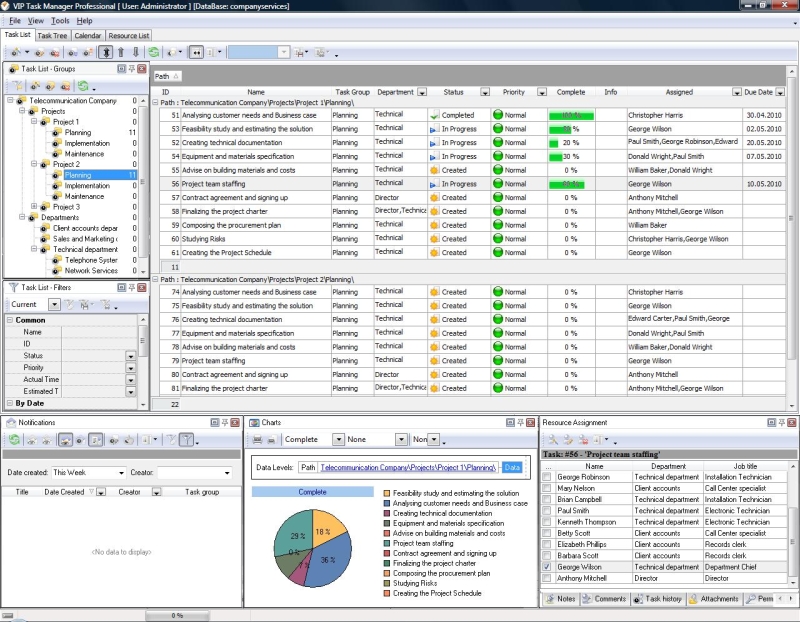

You can manage debtors, creditors, invoicing, bank reconciliation, and more. TurboCASH has comprehensive report features, and it can be configured for different currencies and industries to meet the needs of small businesses around the globe. Project Management: OpenProj There are a lot of moving parts involved with keeping a project on track. You need to manage and allocate personnel, budget, and other resources, and monitor milestones and deadlines. Microsoft Project is a great tool for the job, but it will set you back $456 per userand its fairly complex for the needs of many small and medium businesses. OpenProj works with several file formats including Microsoft Project. Save a ton of money by using OpenProj instead. It gives you very similar features andcapabilities, including Gantt and PERT charts, work breakdown structure, resource breakdown structure, and more. And its similarity to Microsoft Project guarantees a gentle learning curve. CRM: SugarCRM Keeping track of prospects and leads and having tools available to manage your customer relationships is critical for growing your business. Salesforce.com has established itself as a leader in this area, but it runs about $300 per year per user. SugarCRM is offered in several editions so you can expand its capabilities as your business grows. SugarCRM is a full-featured open source platform that provides similar features. SugarCRM Community Edition is free, and as your business and needs grow, you can move up to the Professional, Corporate, Enterprise, or Ultimate editions for a fee. No matter which version you use, you have access to the source code so you can modify the CRM tool to meet your needs. File archiver: 7-Zip WinZip is the de facto standard for file compression software, with a powerful set of tools and options for compressing and decompressing files in a variety of formats.It wont break your budget,

You can manage debtors, creditors, invoicing, bank reconciliation, and more. TurboCASH has comprehensive report features, and it can be configured for different currencies and industries to meet the needs of small businesses around the globe. Project Management: OpenProj There are a lot of moving parts involved with keeping a project on track. You need to manage and allocate personnel, budget, and other resources, and monitor milestones and deadlines. Microsoft Project is a great tool for the job, but it will set you back $456 per userand its fairly complex for the needs of many small and medium businesses. OpenProj works with several file formats including Microsoft Project. Save a ton of money by using OpenProj instead. It gives you very similar features andcapabilities, including Gantt and PERT charts, work breakdown structure, resource breakdown structure, and more. And its similarity to Microsoft Project guarantees a gentle learning curve. CRM: SugarCRM Keeping track of prospects and leads and having tools available to manage your customer relationships is critical for growing your business. Salesforce.com has established itself as a leader in this area, but it runs about $300 per year per user. SugarCRM is offered in several editions so you can expand its capabilities as your business grows. SugarCRM is a full-featured open source platform that provides similar features. SugarCRM Community Edition is free, and as your business and needs grow, you can move up to the Professional, Corporate, Enterprise, or Ultimate editions for a fee. No matter which version you use, you have access to the source code so you can modify the CRM tool to meet your needs. File archiver: 7-Zip WinZip is the de facto standard for file compression software, with a powerful set of tools and options for compressing and decompressing files in a variety of formats.It wont break your budget,  U.S. delays online health insurance enrollment for small businesses Email Print A man looks over the Affordable Care Act (commonly known as Obamacare) signup page on the HealthCare.gov website in New York in this October 2, 2013 photo illustration. Credit: Reuters/Mike Segar WASHINGTON (Reuters) - The Obama administration on Wednesday postponed online health insurance enrollment for small businesses under Obamacare for one year, a move quickly seized upon by critics as proof the healthcare reform law should be delayed or replaced. The announcement affecting businesses with 50 or fewer workers was the latest in a series of delays that have diminished the scope of President Barack Obama's landmark healthcare law, the Patient Protection and Affordable Care Act. Administration officials said the delay stemmed from the need to focus on fixing HealthCare.gov by a Saturday deadline for having the enrollment website working smoothly for most visitors from the 36 states it serves. The online market portal has been hobbled by technical problems since its launch on October 1, frustrating millions of Americans seeking information on new individual health coverage required under the law. "It was important for us to prioritize the functionality that would enable consumers individually to shop and enroll online in coverage," said Julie Bataille, communications director for the Centers for Medicare and Medicaid Services (CMS), the federal agency responsible for the Obamacare marketplaces. Online enrollment for small businesses was originally expected to be available on October 1. Administration officials say they now plan to offer web-based enrollment services by November 2014. Republicans, who want to repeal or fundamentally alter the law, pounced on the fact that the announcement came on the eve of the Thanksgiving Day holiday when many Americans are distracted by travel and family activities. Last summer, the administration delayed the law's coverage mandate for larger businesses just before the July 4 Independence Day holiday. "The administration is doing its best to bury the latest confirmation that this law was not ready for prime time," Representative Fred Upton, chairman of the House Energy and Commerce Committee, said in a statement. The National Federation of Independent Business, a trade group that asked the U.S. Supreme Court to overturn Obamacare in 2012, blasted the announcement as a new burden for employers. "It probably matters little to people in Washington that the failure to get the small business exchanges online adds yet another onerous paperwork requirement for job creators," the organization said. Employers seeking coverage through the federal Small Business Health Options Program, or SHOP, marketplace will be able to enroll off-line through insurance companies, agents and brokers, the administration said. Until now, SHOP enrollment had been available only through paper applications. Administration officials said insurance agents and brokers already serve many small businesses, so the avenue should be familiar to those who want Obamacare coverage for their employees. Businesses with fewer than 50 employees are not required to offer insurance to their workers and have a one-year enrollment period, versus six months for individuals. (Additional reporting by Roberta Rampton in Washington and Lewis Krauskopf in New York; Editing by Michele Gershberg , David Brunnstrom and Philip Barbara ) FILED UNDER:

U.S. delays online health insurance enrollment for small businesses Email Print A man looks over the Affordable Care Act (commonly known as Obamacare) signup page on the HealthCare.gov website in New York in this October 2, 2013 photo illustration. Credit: Reuters/Mike Segar WASHINGTON (Reuters) - The Obama administration on Wednesday postponed online health insurance enrollment for small businesses under Obamacare for one year, a move quickly seized upon by critics as proof the healthcare reform law should be delayed or replaced. The announcement affecting businesses with 50 or fewer workers was the latest in a series of delays that have diminished the scope of President Barack Obama's landmark healthcare law, the Patient Protection and Affordable Care Act. Administration officials said the delay stemmed from the need to focus on fixing HealthCare.gov by a Saturday deadline for having the enrollment website working smoothly for most visitors from the 36 states it serves. The online market portal has been hobbled by technical problems since its launch on October 1, frustrating millions of Americans seeking information on new individual health coverage required under the law. "It was important for us to prioritize the functionality that would enable consumers individually to shop and enroll online in coverage," said Julie Bataille, communications director for the Centers for Medicare and Medicaid Services (CMS), the federal agency responsible for the Obamacare marketplaces. Online enrollment for small businesses was originally expected to be available on October 1. Administration officials say they now plan to offer web-based enrollment services by November 2014. Republicans, who want to repeal or fundamentally alter the law, pounced on the fact that the announcement came on the eve of the Thanksgiving Day holiday when many Americans are distracted by travel and family activities. Last summer, the administration delayed the law's coverage mandate for larger businesses just before the July 4 Independence Day holiday. "The administration is doing its best to bury the latest confirmation that this law was not ready for prime time," Representative Fred Upton, chairman of the House Energy and Commerce Committee, said in a statement. The National Federation of Independent Business, a trade group that asked the U.S. Supreme Court to overturn Obamacare in 2012, blasted the announcement as a new burden for employers. "It probably matters little to people in Washington that the failure to get the small business exchanges online adds yet another onerous paperwork requirement for job creators," the organization said. Employers seeking coverage through the federal Small Business Health Options Program, or SHOP, marketplace will be able to enroll off-line through insurance companies, agents and brokers, the administration said. Until now, SHOP enrollment had been available only through paper applications. Administration officials said insurance agents and brokers already serve many small businesses, so the avenue should be familiar to those who want Obamacare coverage for their employees. Businesses with fewer than 50 employees are not required to offer insurance to their workers and have a one-year enrollment period, versus six months for individuals. (Additional reporting by Roberta Rampton in Washington and Lewis Krauskopf in New York; Editing by Michele Gershberg , David Brunnstrom and Philip Barbara ) FILED UNDER:

But Office Home & Business 2013 will set you back $220 per user, and an Office 365 subscription runs $150 per user per year. LibreOffice is compatible with Microsoft Office file formats. LibreOffice offers the same general functionality in a free package. It works with the standard Microsoft Office file formats, so youll still be able to open and view Office files from others, or share your LibreOffice documents with partners or customers who use the Microsoft suite. It also integrates with Content Management Systems and online document storage for easy collaboration. Email: Thunderbird Email is the primary method of communication for most businesses. There are a number of paid and free email clients available, but Microsoft Outlook is one of the most widely used. Outlook is part of the Microsoft OfficeHome &Business package, as well as themore expensive Microsoft Office Professional suite, or it can be purchased separately for $95. Thunderbird Filelink lets you email large files by uploading them to an online storage provider and sharing the link with the recipient. You can save that $95 per user, though, by switching to Thunderbird for your email. Developed by Mozillathe makers of the Firefox Web browserThunderbird provides comprehensive features including tabbed email, integrated chat, smart folders, and phishing protection. And, like Firefox, its customizable via add-ons. Calendar: Lightning Another function that most businesses rely on Microsoft Outlook for is the calendar. With all your appointments, conference calls, sales meetings, and deadlines, you need a robust calendar tool to manage your days. Mozillas Lightning integrates with Thunderbird for email-related calendaring tasks. Mozilla also has a free tool to fit this need. Lightning integrates with Thunderbird to manage your scheduling, send and receive meeting invitations, and manage events and tasks. You can expand its capabilities with add-ons. Accounting: TurboCASH Its no surprise many businesses rely on Quickbooks to keep their books. The Intuitsoftware helps manage quotes and proposals, invoicing, accounts payable, accounts receivable and more, all from an intuitive interface. But Quickbooks optionsstart around $150. TurboCASH helps you keep track of the money going into and out of your business.

But Office Home & Business 2013 will set you back $220 per user, and an Office 365 subscription runs $150 per user per year. LibreOffice is compatible with Microsoft Office file formats. LibreOffice offers the same general functionality in a free package. It works with the standard Microsoft Office file formats, so youll still be able to open and view Office files from others, or share your LibreOffice documents with partners or customers who use the Microsoft suite. It also integrates with Content Management Systems and online document storage for easy collaboration. Email: Thunderbird Email is the primary method of communication for most businesses. There are a number of paid and free email clients available, but Microsoft Outlook is one of the most widely used. Outlook is part of the Microsoft OfficeHome &Business package, as well as themore expensive Microsoft Office Professional suite, or it can be purchased separately for $95. Thunderbird Filelink lets you email large files by uploading them to an online storage provider and sharing the link with the recipient. You can save that $95 per user, though, by switching to Thunderbird for your email. Developed by Mozillathe makers of the Firefox Web browserThunderbird provides comprehensive features including tabbed email, integrated chat, smart folders, and phishing protection. And, like Firefox, its customizable via add-ons. Calendar: Lightning Another function that most businesses rely on Microsoft Outlook for is the calendar. With all your appointments, conference calls, sales meetings, and deadlines, you need a robust calendar tool to manage your days. Mozillas Lightning integrates with Thunderbird for email-related calendaring tasks. Mozilla also has a free tool to fit this need. Lightning integrates with Thunderbird to manage your scheduling, send and receive meeting invitations, and manage events and tasks. You can expand its capabilities with add-ons. Accounting: TurboCASH Its no surprise many businesses rely on Quickbooks to keep their books. The Intuitsoftware helps manage quotes and proposals, invoicing, accounts payable, accounts receivable and more, all from an intuitive interface. But Quickbooks optionsstart around $150. TurboCASH helps you keep track of the money going into and out of your business. Paul Business Journal Send this story to a friend Email address of friend (insert comma between multiple addresses): Your email address: Nov 27, 2013, 1:09pm CST Software startup KeyedIn raises $1.5M Business-software maker KeyedIn Solutions has closed on nearly $1.5 million in equity financing, according to a regulatory filing. The round of funding comes about six months after Bloomington-based KeyedIn raised $16.3 million . Former Epicor Software sales executive Lauri Klaus launched KeyedIn in 2011. The company went on to expand quickly through a string of acquisitions. KeyedIn makes project-management software and technology that companies use to build Web applications. It also develops software for the manufacturing market. The company recently expanded into Florida, opening an office in Fort Myers that employs about 10 people. Katharine Grayson covers med tech, clean tech, technology, health care, and venture capital, and she writes the Innovation|Minnesota blog Industries:

Paul Business Journal Send this story to a friend Email address of friend (insert comma between multiple addresses): Your email address: Nov 27, 2013, 1:09pm CST Software startup KeyedIn raises $1.5M Business-software maker KeyedIn Solutions has closed on nearly $1.5 million in equity financing, according to a regulatory filing. The round of funding comes about six months after Bloomington-based KeyedIn raised $16.3 million . Former Epicor Software sales executive Lauri Klaus launched KeyedIn in 2011. The company went on to expand quickly through a string of acquisitions. KeyedIn makes project-management software and technology that companies use to build Web applications. It also develops software for the manufacturing market. The company recently expanded into Florida, opening an office in Fort Myers that employs about 10 people. Katharine Grayson covers med tech, clean tech, technology, health care, and venture capital, and she writes the Innovation|Minnesota blog Industries:  U.S. small business hiring up despite government shutdown WASHINGTON Wed Nov 6, 2013 12:07pm EST Email Print A job seeker (L) makes her pitch to a recruiter at the Colorado Hospital Association health care career fair in Denver April 9, 2013. Credit: Reuters/Rick Wilking WASHINGTON (Reuters) - U.S. small businesses stepped up hiring in October, despite uncertainty brought by a partial shutdown of the federal government, a survey showed on Wednesday. The National Federation of Independent Business said small business owners added an average of 0.11 workers per firm last month, reversing September's decline. "In spite of the government shut-down, employment rose among small firms in October," the NFIB said in a statement. The increase in hiring by small businesses is an encouraging sign for the economy amid estimates that the 16-day government shutdown could have sliced off as much as 0.6 percentage point from fourth quarter gross domestic product (GDP) growth. The NFIB's findings come ahead of the release on Friday of the government's comprehensive employment report for October, which is expected to show that the shutdown held back hiring. Non-farm payrolls are forecast to have risen by only 125,000 jobs last month, according to a Reuters survey of economists, down from an increase of 148,000 in September. The NFIB survey found that 12 percent of small business owners throughout the country added an average of 3.5 workers per firm over the past few months. That was a slight improvement from prior periods. About nine percent of businesses, the smallest share since 2006, reported laying off an average of 2.8 workers. "Reports of workforce reductions have reached sub-normal levels. But owners report sub-par levels of hiring, so job growth remains anemic," the NFIB said. There was a slight increase in the share of business owners reporting hard-to-fill job openings. There was also a modest increase in the number of employers hiring temporary workers. Temporary employment is seen as a harbinger of future hiring, but could also indicate reluctance by employers to take on full-time workers because of uncertainty related to health care regulations and the economic outlook. (Reporting by Lucia Mutikani ; Editing by Meredith Mazzilli) FILED UNDER:

U.S. small business hiring up despite government shutdown WASHINGTON Wed Nov 6, 2013 12:07pm EST Email Print A job seeker (L) makes her pitch to a recruiter at the Colorado Hospital Association health care career fair in Denver April 9, 2013. Credit: Reuters/Rick Wilking WASHINGTON (Reuters) - U.S. small businesses stepped up hiring in October, despite uncertainty brought by a partial shutdown of the federal government, a survey showed on Wednesday. The National Federation of Independent Business said small business owners added an average of 0.11 workers per firm last month, reversing September's decline. "In spite of the government shut-down, employment rose among small firms in October," the NFIB said in a statement. The increase in hiring by small businesses is an encouraging sign for the economy amid estimates that the 16-day government shutdown could have sliced off as much as 0.6 percentage point from fourth quarter gross domestic product (GDP) growth. The NFIB's findings come ahead of the release on Friday of the government's comprehensive employment report for October, which is expected to show that the shutdown held back hiring. Non-farm payrolls are forecast to have risen by only 125,000 jobs last month, according to a Reuters survey of economists, down from an increase of 148,000 in September. The NFIB survey found that 12 percent of small business owners throughout the country added an average of 3.5 workers per firm over the past few months. That was a slight improvement from prior periods. About nine percent of businesses, the smallest share since 2006, reported laying off an average of 2.8 workers. "Reports of workforce reductions have reached sub-normal levels. But owners report sub-par levels of hiring, so job growth remains anemic," the NFIB said. There was a slight increase in the share of business owners reporting hard-to-fill job openings. There was also a modest increase in the number of employers hiring temporary workers. Temporary employment is seen as a harbinger of future hiring, but could also indicate reluctance by employers to take on full-time workers because of uncertainty related to health care regulations and the economic outlook. (Reporting by Lucia Mutikani ; Editing by Meredith Mazzilli) FILED UNDER:

Besides selling their products and services, small business owners also have

Besides selling their products and services, small business owners also have  has received the PCMag.com Readers Choice Award for Service and Reliability in

has received the PCMag.com Readers Choice Award for Service and Reliability in  More U.S. small businesses plan for employee health coverage: survey By Lewis Krauskopf Email Print (Reuters) - The number of U.S. small businesses planning to start to offer health coverage for their employees next year slightly exceeds the number that expect to drop coverage, even as costs continue to rise, according to a survey released on Thursday. The survey by the National Federation of Independent Business, a trade organization, was designed as the first of a three-year look at how small businesses are adapting to President Barack Obama's healthcare law. The survey did not, however, ask respondents if they were being influenced in their plans to start coverage by the new law. Many of the Affordable Care Act's important regulations begin next year, although a requirement that employers with at least 50 workers supply health coverage was delayed until 2015. If employers follow through on their plans for next year, "the net proportion of them offering (health insurance) would rise, breaking a decade-old trend," said the report, which surveyed 921 businesses, with from two to 100 employees. Businesses reported their healthcare costs increased nearly 12 percent on average for this year, and said they responded by taking less profit and delaying business investment, according to the survey. Health insurance premiums averaged $6,271 a month for small businesses. Sixty-four percent paid more per employee for healthcare than the prior year, with 6 percent reporting a decline and the rest reporting no change. The survey did not ask for reasons behind the cost increases. About two-thirds of employers reported responding to the higher costs by taking lower profits, while 40 percent said they reduced or delayed business investment. Some also passed the costs onto employees: 37 percent froze or reduced wages and 30 percent raised the employee cost share for healthcare. Also, 30 percent raised their selling prices as a response. "They are absorbing a lot of that internally right now, which results in less investment in the kinds of things one would hope would occur to expand the economy," William Dennis, the study's author and a senior fellow at the NFIB Research Foundation, told reporters in a briefing. The study also found that 13 percent of businesses plan to cut the hours of part-time workers next year, but that at most half of those cuts related to the healthcare law. The law defines a full-time worker as one who works 30 hours a week. Critics have said that businesses would cut hours of workers to avoid regulations. (Reporting by Lewis Krauskopf; Editing by Leslie Adler) FILED UNDER:

More U.S. small businesses plan for employee health coverage: survey By Lewis Krauskopf Email Print (Reuters) - The number of U.S. small businesses planning to start to offer health coverage for their employees next year slightly exceeds the number that expect to drop coverage, even as costs continue to rise, according to a survey released on Thursday. The survey by the National Federation of Independent Business, a trade organization, was designed as the first of a three-year look at how small businesses are adapting to President Barack Obama's healthcare law. The survey did not, however, ask respondents if they were being influenced in their plans to start coverage by the new law. Many of the Affordable Care Act's important regulations begin next year, although a requirement that employers with at least 50 workers supply health coverage was delayed until 2015. If employers follow through on their plans for next year, "the net proportion of them offering (health insurance) would rise, breaking a decade-old trend," said the report, which surveyed 921 businesses, with from two to 100 employees. Businesses reported their healthcare costs increased nearly 12 percent on average for this year, and said they responded by taking less profit and delaying business investment, according to the survey. Health insurance premiums averaged $6,271 a month for small businesses. Sixty-four percent paid more per employee for healthcare than the prior year, with 6 percent reporting a decline and the rest reporting no change. The survey did not ask for reasons behind the cost increases. About two-thirds of employers reported responding to the higher costs by taking lower profits, while 40 percent said they reduced or delayed business investment. Some also passed the costs onto employees: 37 percent froze or reduced wages and 30 percent raised the employee cost share for healthcare. Also, 30 percent raised their selling prices as a response. "They are absorbing a lot of that internally right now, which results in less investment in the kinds of things one would hope would occur to expand the economy," William Dennis, the study's author and a senior fellow at the NFIB Research Foundation, told reporters in a briefing. The study also found that 13 percent of businesses plan to cut the hours of part-time workers next year, but that at most half of those cuts related to the healthcare law. The law defines a full-time worker as one who works 30 hours a week. Critics have said that businesses would cut hours of workers to avoid regulations. (Reporting by Lewis Krauskopf; Editing by Leslie Adler) FILED UNDER:

By Paul Rubens CIO Take a look at the next desktop PC or laptop you come across. Odds are good it won't be running an open-source operating system. Microsoft's closed-source Windows has by far the highest share of the PC client operating system market, followed in a distant second by Apple's Mac OS X. Linux and other wholly open source operating systems have only a tiny market share. It's not hard to see why. Despite the advances made by distributions such as Ubuntu, desktop Linux is still miles behind Windows and OS X in terms of the look, the feel and the slickness that most office workers have come to expect.

By Paul Rubens CIO Take a look at the next desktop PC or laptop you come across. Odds are good it won't be running an open-source operating system. Microsoft's closed-source Windows has by far the highest share of the PC client operating system market, followed in a distant second by Apple's Mac OS X. Linux and other wholly open source operating systems have only a tiny market share. It's not hard to see why. Despite the advances made by distributions such as Ubuntu, desktop Linux is still miles behind Windows and OS X in terms of the look, the feel and the slickness that most office workers have come to expect.  Each year, thousands of users trust W2 Mate for high-quality, easy, affordable and above all reliable 1099 processing. The 1099 tax returns generated using W2 Mate are government-approved and comply with SSA publication 1141 (General Rules and Specifications for Substitute Forms W-2) and IRS publication 1179 (General Rules and Specifications for Substitute Forms 1099). In a statement Nancy Walters, W2 Mate product manager at Real Business Solutions said, "Keeping up with all the 1099 filing regulations can be a bit overwhelming and time consuming for business filers. That is why we built W2 Mate, the easy-to-use W2 1099 processing solution for US businesses and tax practitioners." Software highlights: Complies with 2013 IRS Specifications for Filing Forms 1099 electronically and complies with SSA Specifications for Filing Forms W-2 Electronically (EFW2). Supports Electronic Delivery of W2s to employees and 1099 Forms to recipients. Supports Bulk 1099 TIN Matching. Supports SSN masking on 1099 forms. Ability to file 1099 corrections. Supports Windows 8.1, Windows 8, Windows 7, Windows Vista, Windows XP and Windows Server 2003. For paper filers, fills in pre-printed 1099 Copy-A forms and prints other copies such as recipient and payer copies on plain paper using black ink. Free updates and free technical support. Creates employee W2's as PDF and recipient (contractor) 1099's as PDF. Prints government-approved W-2 W-3 forms on regular paper . Automatically calculates Social Security and Medicare. Imports data from Intuit QuickBooks, Microsoft Dynamics (GP or SL), Sage 50 (Peachtree), Sage DacEasy or CSV/ Excel. Efficient and intuitive manual W2 / 1099 data entry.

Each year, thousands of users trust W2 Mate for high-quality, easy, affordable and above all reliable 1099 processing. The 1099 tax returns generated using W2 Mate are government-approved and comply with SSA publication 1141 (General Rules and Specifications for Substitute Forms W-2) and IRS publication 1179 (General Rules and Specifications for Substitute Forms 1099). In a statement Nancy Walters, W2 Mate product manager at Real Business Solutions said, "Keeping up with all the 1099 filing regulations can be a bit overwhelming and time consuming for business filers. That is why we built W2 Mate, the easy-to-use W2 1099 processing solution for US businesses and tax practitioners." Software highlights: Complies with 2013 IRS Specifications for Filing Forms 1099 electronically and complies with SSA Specifications for Filing Forms W-2 Electronically (EFW2). Supports Electronic Delivery of W2s to employees and 1099 Forms to recipients. Supports Bulk 1099 TIN Matching. Supports SSN masking on 1099 forms. Ability to file 1099 corrections. Supports Windows 8.1, Windows 8, Windows 7, Windows Vista, Windows XP and Windows Server 2003. For paper filers, fills in pre-printed 1099 Copy-A forms and prints other copies such as recipient and payer copies on plain paper using black ink. Free updates and free technical support. Creates employee W2's as PDF and recipient (contractor) 1099's as PDF. Prints government-approved W-2 W-3 forms on regular paper . Automatically calculates Social Security and Medicare. Imports data from Intuit QuickBooks, Microsoft Dynamics (GP or SL), Sage 50 (Peachtree), Sage DacEasy or CSV/ Excel. Efficient and intuitive manual W2 / 1099 data entry.