Friday, November 29, 2013

Investors Flock To Europe In Search Of Next Supercell

Wednesday, November 27, 2013

Original Software Further Reduces The Pain Of Maintaining Enterprise Applications

Software startup KeyedIn raises https://www.youtube.com/watch?v=nFIpwcqrWOE $1.5M

For most companies, the process of ensuring that updated applications still meet the needs of the business requires users and IT to perform hundreds or thousands of man-days of manual work. But our software streamlines the entire process. Through automation, we can reduce validation work by 75 per cent and virtually eliminate application defects. Our solution requires no specialist skills and can be deployed within days, bringing immediate respite to organizations that suffer from having staff taken away from their core tasks. About Original Software: Original Software enables organizations to meet their objectives more rapidly by delivering enterprise application functionality frequently and efficiently. Knowledge workers and IT professionals use our technology to streamline user acceptance testing, conference room pilots, manual and automated testing, project management, and regulatory audit of applications.

For most companies, the process of ensuring that updated applications still meet the needs of the business requires users and IT to perform hundreds or thousands of man-days of manual work. But our software streamlines the entire process. Through automation, we can reduce validation work by 75 per cent and virtually eliminate application defects. Our solution requires no specialist skills and can be deployed within days, bringing immediate respite to organizations that suffer from having staff taken away from their core tasks. About Original Software: Original Software enables organizations to meet their objectives more rapidly by delivering enterprise application functionality frequently and efficiently. Knowledge workers and IT professionals use our technology to streamline user acceptance testing, conference room pilots, manual and automated testing, project management, and regulatory audit of applications.

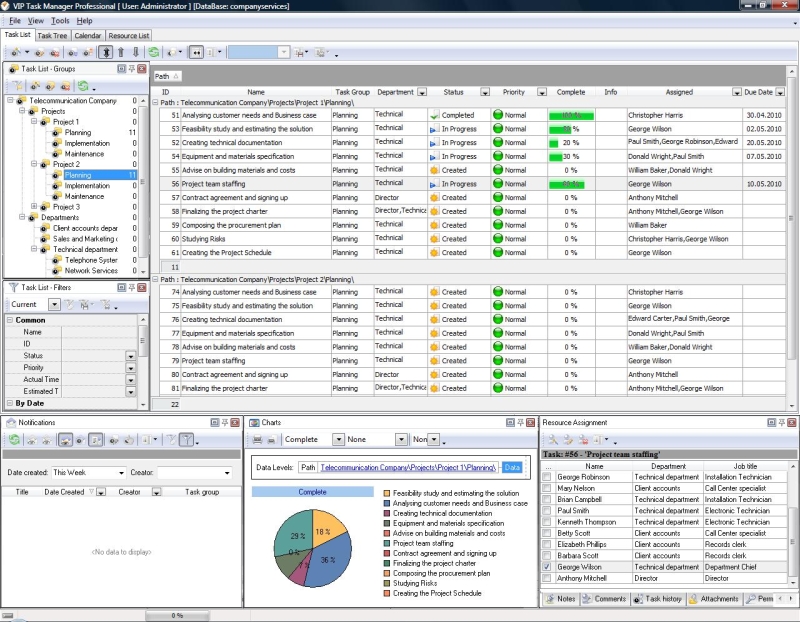

Paul Business Journal Send this story to a friend Email address of friend (insert comma between multiple addresses): Your email address: Nov 27, 2013, 1:09pm CST Software startup KeyedIn raises $1.5M Business-software maker KeyedIn Solutions has closed on nearly $1.5 million in equity financing, according to a regulatory filing. The round of funding comes about six months after Bloomington-based KeyedIn raised $16.3 million . Former Epicor Software sales executive Lauri Klaus launched KeyedIn in 2011. The company went on to expand quickly through a string of acquisitions. KeyedIn makes project-management software and technology that companies use to build Web applications. It also develops software for the manufacturing market. The company recently expanded into Florida, opening an office in Fort Myers that employs about 10 people. Katharine Grayson covers med tech, clean tech, technology, health care, and venture capital, and she writes the Innovation|Minnesota blog Industries:

Paul Business Journal Send this story to a friend Email address of friend (insert comma between multiple addresses): Your email address: Nov 27, 2013, 1:09pm CST Software startup KeyedIn raises $1.5M Business-software maker KeyedIn Solutions has closed on nearly $1.5 million in equity financing, according to a regulatory filing. The round of funding comes about six months after Bloomington-based KeyedIn raised $16.3 million . Former Epicor Software sales executive Lauri Klaus launched KeyedIn in 2011. The company went on to expand quickly through a string of acquisitions. KeyedIn makes project-management software and technology that companies use to build Web applications. It also develops software for the manufacturing market. The company recently expanded into Florida, opening an office in Fort Myers that employs about 10 people. Katharine Grayson covers med tech, clean tech, technology, health care, and venture capital, and she writes the Innovation|Minnesota blog Industries:

Tuesday, November 26, 2013

U.s. Small Business Hiring Up Despite Government Shutdown

U.S. small business hiring up despite government shutdown WASHINGTON Wed Nov 6, 2013 12:07pm EST Email Print A job seeker (L) makes her pitch to a recruiter at the Colorado Hospital Association health care career fair in Denver April 9, 2013. Credit: Reuters/Rick Wilking WASHINGTON (Reuters) - U.S. small businesses stepped up hiring in October, despite uncertainty brought by a partial shutdown of the federal government, a survey showed on Wednesday. The National Federation of Independent Business said small business owners added an average of 0.11 workers per firm last month, reversing September's decline. "In spite of the government shut-down, employment rose among small firms in October," the NFIB said in a statement. The increase in hiring by small businesses is an encouraging sign for the economy amid estimates that the 16-day government shutdown could have sliced off as much as 0.6 percentage point from fourth quarter gross domestic product (GDP) growth. The NFIB's findings come ahead of the release on Friday of the government's comprehensive employment report for October, which is expected to show that the shutdown held back hiring. Non-farm payrolls are forecast to have risen by only 125,000 jobs last month, according to a Reuters survey of economists, down from an increase of 148,000 in September. The NFIB survey found that 12 percent of small business owners throughout the country added an average of 3.5 workers per firm over the past few months. That was a slight improvement from prior periods. About nine percent of businesses, the smallest share since 2006, reported laying off an average of 2.8 workers. "Reports of workforce reductions have reached sub-normal levels. But owners report sub-par levels of hiring, so job growth remains anemic," the NFIB said. There was a slight increase in the share of business owners reporting hard-to-fill job openings. There was also a modest increase in the number of employers hiring temporary workers. Temporary employment is seen as a harbinger of future hiring, but could also indicate reluctance by employers to take on full-time workers because of uncertainty related to health care regulations and the economic outlook. (Reporting by Lucia Mutikani ; Editing by Meredith Mazzilli) FILED UNDER:

U.S. small business hiring up despite government shutdown WASHINGTON Wed Nov 6, 2013 12:07pm EST Email Print A job seeker (L) makes her pitch to a recruiter at the Colorado Hospital Association health care career fair in Denver April 9, 2013. Credit: Reuters/Rick Wilking WASHINGTON (Reuters) - U.S. small businesses stepped up hiring in October, despite uncertainty brought by a partial shutdown of the federal government, a survey showed on Wednesday. The National Federation of Independent Business said small business owners added an average of 0.11 workers per firm last month, reversing September's decline. "In spite of the government shut-down, employment rose among small firms in October," the NFIB said in a statement. The increase in hiring by small businesses is an encouraging sign for the economy amid estimates that the 16-day government shutdown could have sliced off as much as 0.6 percentage point from fourth quarter gross domestic product (GDP) growth. The NFIB's findings come ahead of the release on Friday of the government's comprehensive employment report for October, which is expected to show that the shutdown held back hiring. Non-farm payrolls are forecast to have risen by only 125,000 jobs last month, according to a Reuters survey of economists, down from an increase of 148,000 in September. The NFIB survey found that 12 percent of small business owners throughout the country added an average of 3.5 workers per firm over the past few months. That was a slight improvement from prior periods. About nine percent of businesses, the smallest share since 2006, reported laying off an average of 2.8 workers. "Reports of workforce reductions have reached sub-normal levels. But owners report sub-par levels of hiring, so job growth remains anemic," the NFIB said. There was a slight increase in the share of business owners reporting hard-to-fill job openings. There was also a modest increase in the number of employers hiring temporary workers. Temporary employment is seen as a harbinger of future hiring, but could also indicate reluctance by employers to take on full-time workers because of uncertainty related to health care regulations and the economic outlook. (Reporting by Lucia Mutikani ; Editing by Meredith Mazzilli) FILED UNDER:

Sunday, November 24, 2013

Investors Flock To Europe In Search Of Next Supercell

The Emerging Software Ecosystem For Running Small Businesses

Besides selling their products and services, small business owners also have The top Home organizer software to balance budgets, keep track of accounts receivable, run payroll, pay taxes, and manage a myriad of other unsexy tasks behind the scenes. Recognizing the pains associated with running a business, companies like Square, Xero, Bill.com, Freshbooks, Expensify and ZenPayroll (disclosure: my company) are applying the principles of modern software to design and deliver beautiful solutions that make it easier to take care of these critical responsibilities. As a result, startups and small businesses alike have adopted modern software in droves. But what does modern software mean for small businesses? There are a couple key ingredients that many of these software companies are leveraging and their product philosophy is driven by a deep empathy for the user and solving their problem. These ingredients are: beautiful design, ease of use, mobile accessibility and APIs. 1. Appealing design can and should involve interfaces that naturally please the eye, such as the minimalist interface for Square Cash. 2. However, the visuals must be married with a keen focus on user experience. In other words, the application should be so intuitive that its hard for people to make mistakes. Philip Fierlinger, Head of Design at Xero, has shared intriguing ideas on how to improve the UX of money , for example. Nobody wants to make mistakes with money. 3. Mobile devices have already become staples in our personal lives. It makes sense for people to manage business on-the-go as well, tracking expenses with Expensify or accepting payments with Square. 4. Good-looking apps arent useful unless they work with each other. As Y Combinator Partner Garry Tan put it, the API-ization of everything is upon us. While payroll has historically been a silo, ZenPayroll recently launched an API (short for application programming interface) that made it into a distributed, integrated layer.

Besides selling their products and services, small business owners also have The top Home organizer software to balance budgets, keep track of accounts receivable, run payroll, pay taxes, and manage a myriad of other unsexy tasks behind the scenes. Recognizing the pains associated with running a business, companies like Square, Xero, Bill.com, Freshbooks, Expensify and ZenPayroll (disclosure: my company) are applying the principles of modern software to design and deliver beautiful solutions that make it easier to take care of these critical responsibilities. As a result, startups and small businesses alike have adopted modern software in droves. But what does modern software mean for small businesses? There are a couple key ingredients that many of these software companies are leveraging and their product philosophy is driven by a deep empathy for the user and solving their problem. These ingredients are: beautiful design, ease of use, mobile accessibility and APIs. 1. Appealing design can and should involve interfaces that naturally please the eye, such as the minimalist interface for Square Cash. 2. However, the visuals must be married with a keen focus on user experience. In other words, the application should be so intuitive that its hard for people to make mistakes. Philip Fierlinger, Head of Design at Xero, has shared intriguing ideas on how to improve the UX of money , for example. Nobody wants to make mistakes with money. 3. Mobile devices have already become staples in our personal lives. It makes sense for people to manage business on-the-go as well, tracking expenses with Expensify or accepting payments with Square. 4. Good-looking apps arent useful unless they work with each other. As Y Combinator Partner Garry Tan put it, the API-ization of everything is upon us. While payroll has historically been a silo, ZenPayroll recently launched an API (short for application programming interface) that made it into a distributed, integrated layer.

Friday, November 22, 2013

Aggiornamento Software Modello Di Comunicazione Polivalente (spesometro) 1.1.0 Per Mac, Windows E Linux | Il Bloggatore

Matteo80 : Avete provato se funziona con windows 8? perche io ho qualche problema con il dr... olhodaguaweb.com : Thanks in favor of sharing such a nice opinion, post is fastidious, thats why i ... antonio : ciao senta e possibile avere il codice x sbloccare il mio autoradio ii n serial ... ricardo : ciao starei trovando un film che si tratta due gemelle che si incontrano al camp... La classifica:

Thursday, November 21, 2013

Sec's Gallagher Calls For Exchanges To List Small Start-ups

Tuesday, November 19, 2013

Canon Information And Imaging Solutions, Inc. Announces The Availability Of Print It Infrastructure Management Services

has received the PCMag.com Readers Choice Award for Service and Reliability in contact organizers the digital camera and printer categories for the tenth consecutive year, and for camcorders for the past three years. Canon U.S.A.

has received the PCMag.com Readers Choice Award for Service and Reliability in contact organizers the digital camera and printer categories for the tenth consecutive year, and for camcorders for the past three years. Canon U.S.A.

Jpmorgan Chase Gains In Small Business Satisfaction Ranking

JPMorgan Chase gains in small business satisfaction ranking NEW YORK Wed Oct 30, 2013 12:20pm EDT Email Print A sign outside the headquarters of JP Morgan Chase & Co in New York, September 19, 2013. Credit: Reuters/Mike Segar NEW YORK (Reuters) - JPMorgan Chase & Co (JPM.N) ranked first in a small business customer satisfaction survey in three of four regions of the United States, a sharp improvement from 20th place nationally two years ago, research firm J.D. Power and said on Wednesday. The bank raised its ranking through changes to its customer service, which was previously slow to fix problems. Clients complained about having to deal with a different staff member every time they called the bank so JPMorgan assigned relationship managers to many customers, giving them a single point of contact, said Scott Geller, JPMorgan's chief executive for its small business unit. The top ranking may also have been because of a simpler factor, namely branch hours and locations, said Jim Miller, senior director of banking at J.D. Power. Small businesses still have a lot of cash and paper checks to deposit, so they need convenient branches, Miller said. He noted that in the Northeast, where JPMorgan ranked fifth, the bank that was first is the one that keeps its branches open for the most hours each week, Toronto-Dominion Bank's TD Bank. (TD.TO) JPMorgan has continued to spend money to add and remodel branches in recent years even as other banks have closed offices to cut costs and take advantage of customers doing more of their transactions with mobile devices. The bank, which lends to small businesses through its 5,600 Chase branches, ranked above other lenders in the Midwest, West and South, J.D. Power said. "A couple of years ago they were performing near the bottom," said Jim Miller, senior director of banking at J.D. Power. "They have made a dramatic improvement in a short time." JPMorgan's Geller said he is setting out to learn how TD Bank beat his bank in the Northeast in the survey. "We will give a good hard look at TD's results," Geller said. (Reporting by David Henry in New York. Editing by Dan Wilchins and Andrew Hay) FILED UNDER:

JPMorgan Chase gains in small business satisfaction ranking NEW YORK Wed Oct 30, 2013 12:20pm EDT Email Print A sign outside the headquarters of JP Morgan Chase & Co in New York, September 19, 2013. Credit: Reuters/Mike Segar NEW YORK (Reuters) - JPMorgan Chase & Co (JPM.N) ranked first in a small business customer satisfaction survey in three of four regions of the United States, a sharp improvement from 20th place nationally two years ago, research firm J.D. Power and said on Wednesday. The bank raised its ranking through changes to its customer service, which was previously slow to fix problems. Clients complained about having to deal with a different staff member every time they called the bank so JPMorgan assigned relationship managers to many customers, giving them a single point of contact, said Scott Geller, JPMorgan's chief executive for its small business unit. The top ranking may also have been because of a simpler factor, namely branch hours and locations, said Jim Miller, senior director of banking at J.D. Power. Small businesses still have a lot of cash and paper checks to deposit, so they need convenient branches, Miller said. He noted that in the Northeast, where JPMorgan ranked fifth, the bank that was first is the one that keeps its branches open for the most hours each week, Toronto-Dominion Bank's TD Bank. (TD.TO) JPMorgan has continued to spend money to add and remodel branches in recent years even as other banks have closed offices to cut costs and take advantage of customers doing more of their transactions with mobile devices. The bank, which lends to small businesses through its 5,600 Chase branches, ranked above other lenders in the Midwest, West and South, J.D. Power said. "A couple of years ago they were performing near the bottom," said Jim Miller, senior director of banking at J.D. Power. "They have made a dramatic improvement in a short time." JPMorgan's Geller said he is setting out to learn how TD Bank beat his bank in the Northeast in the survey. "We will give a good hard look at TD's results," Geller said. (Reporting by David Henry in New York. Editing by Dan Wilchins and Andrew Hay) FILED UNDER:

Saturday, November 16, 2013

More U.s. Small Businesses Plan For Employee Health Coverage: Survey

More U.S. small businesses plan for employee health coverage: survey By Lewis Krauskopf Email Print (Reuters) - The number of U.S. small businesses planning to start to offer health coverage for their employees next year slightly exceeds the number that expect to drop coverage, even as costs continue to rise, according to a survey released on Thursday. The survey by the National Federation of Independent Business, a trade organization, was designed as the first of a three-year look at how small businesses are adapting to President Barack Obama's healthcare law. The survey did not, however, ask respondents if they were being influenced in their plans to start coverage by the new law. Many of the Affordable Care Act's important regulations begin next year, although a requirement that employers with at least 50 workers supply health coverage was delayed until 2015. If employers follow through on their plans for next year, "the net proportion of them offering (health insurance) would rise, breaking a decade-old trend," said the report, which surveyed 921 businesses, with from two to 100 employees. Businesses reported their healthcare costs increased nearly 12 percent on average for this year, and said they responded by taking less profit and delaying business investment, according to the survey. Health insurance premiums averaged $6,271 a month for small businesses. Sixty-four percent paid more per employee for healthcare than the prior year, with 6 percent reporting a decline and the rest reporting no change. The survey did not ask for reasons behind the cost increases. About two-thirds of employers reported responding to the higher costs by taking lower profits, while 40 percent said they reduced or delayed business investment. Some also passed the costs onto employees: 37 percent froze or reduced wages and 30 percent raised the employee cost share for healthcare. Also, 30 percent raised their selling prices as a response. "They are absorbing a lot of that internally right now, which results in less investment in the kinds of things one would hope would occur to expand the economy," William Dennis, the study's author and a senior fellow at the NFIB Research Foundation, told reporters in a briefing. The study also found that 13 percent of businesses plan to cut the hours of part-time workers next year, but that at most half of those cuts related to the healthcare law. The law defines a full-time worker as one who works 30 hours a week. Critics have said that businesses would cut hours of workers to avoid regulations. (Reporting by Lewis Krauskopf; Editing by Leslie Adler) FILED UNDER:

More U.S. small businesses plan for employee health coverage: survey By Lewis Krauskopf Email Print (Reuters) - The number of U.S. small businesses planning to start to offer health coverage for their employees next year slightly exceeds the number that expect to drop coverage, even as costs continue to rise, according to a survey released on Thursday. The survey by the National Federation of Independent Business, a trade organization, was designed as the first of a three-year look at how small businesses are adapting to President Barack Obama's healthcare law. The survey did not, however, ask respondents if they were being influenced in their plans to start coverage by the new law. Many of the Affordable Care Act's important regulations begin next year, although a requirement that employers with at least 50 workers supply health coverage was delayed until 2015. If employers follow through on their plans for next year, "the net proportion of them offering (health insurance) would rise, breaking a decade-old trend," said the report, which surveyed 921 businesses, with from two to 100 employees. Businesses reported their healthcare costs increased nearly 12 percent on average for this year, and said they responded by taking less profit and delaying business investment, according to the survey. Health insurance premiums averaged $6,271 a month for small businesses. Sixty-four percent paid more per employee for healthcare than the prior year, with 6 percent reporting a decline and the rest reporting no change. The survey did not ask for reasons behind the cost increases. About two-thirds of employers reported responding to the higher costs by taking lower profits, while 40 percent said they reduced or delayed business investment. Some also passed the costs onto employees: 37 percent froze or reduced wages and 30 percent raised the employee cost share for healthcare. Also, 30 percent raised their selling prices as a response. "They are absorbing a lot of that internally right now, which results in less investment in the kinds of things one would hope would occur to expand the economy," William Dennis, the study's author and a senior fellow at the NFIB Research Foundation, told reporters in a briefing. The study also found that 13 percent of businesses plan to cut the hours of part-time workers next year, but that at most half of those cuts related to the healthcare law. The law defines a full-time worker as one who works 30 hours a week. Critics have said that businesses would cut hours of workers to avoid regulations. (Reporting by Lewis Krauskopf; Editing by Leslie Adler) FILED UNDER:

How To Run Your Small Business With Free Open Source Software

1099 Software and Forms Updated for 2014; Announces W2Mate.com

Each year, thousands of users trust W2 Mate for high-quality, easy, affordable and above all reliable 1099 processing. The 1099 tax returns generated using W2 Mate are government-approved and comply with SSA publication 1141 (General Rules and Specifications for Substitute Forms W-2) and IRS publication 1179 (General Rules and Specifications for Substitute Forms 1099). In a statement Nancy Walters, W2 Mate product manager at Real Business Solutions said, "Keeping up with all the 1099 filing regulations can be a bit overwhelming and time consuming for business filers. That is why we built W2 Mate, the easy-to-use W2 1099 processing solution for US businesses and tax practitioners." Software highlights: Complies with 2013 IRS Specifications for Filing Forms 1099 electronically and complies with SSA Specifications for Filing Forms W-2 Electronically (EFW2). Supports Electronic Delivery of W2s to employees and 1099 Forms to recipients. Supports Bulk 1099 TIN Matching. Supports SSN masking on 1099 forms. Ability to file 1099 corrections. Supports Windows 8.1, Windows 8, Windows 7, Windows Vista, Windows XP and Windows Server 2003. For paper filers, fills in pre-printed 1099 Copy-A forms and prints other copies such as recipient and payer copies on plain paper using black ink. Free updates and free technical support. Creates employee W2's as PDF and recipient (contractor) 1099's as PDF. Prints government-approved W-2 W-3 forms on regular paper . Automatically calculates Social Security and Medicare. Imports data from Intuit QuickBooks, Microsoft Dynamics (GP or SL), Sage 50 (Peachtree), Sage DacEasy or CSV/ Excel. Efficient and intuitive manual W2 / 1099 data entry.

Each year, thousands of users trust W2 Mate for high-quality, easy, affordable and above all reliable 1099 processing. The 1099 tax returns generated using W2 Mate are government-approved and comply with SSA publication 1141 (General Rules and Specifications for Substitute Forms W-2) and IRS publication 1179 (General Rules and Specifications for Substitute Forms 1099). In a statement Nancy Walters, W2 Mate product manager at Real Business Solutions said, "Keeping up with all the 1099 filing regulations can be a bit overwhelming and time consuming for business filers. That is why we built W2 Mate, the easy-to-use W2 1099 processing solution for US businesses and tax practitioners." Software highlights: Complies with 2013 IRS Specifications for Filing Forms 1099 electronically and complies with SSA Specifications for Filing Forms W-2 Electronically (EFW2). Supports Electronic Delivery of W2s to employees and 1099 Forms to recipients. Supports Bulk 1099 TIN Matching. Supports SSN masking on 1099 forms. Ability to file 1099 corrections. Supports Windows 8.1, Windows 8, Windows 7, Windows Vista, Windows XP and Windows Server 2003. For paper filers, fills in pre-printed 1099 Copy-A forms and prints other copies such as recipient and payer copies on plain paper using black ink. Free updates and free technical support. Creates employee W2's as PDF and recipient (contractor) 1099's as PDF. Prints government-approved W-2 W-3 forms on regular paper . Automatically calculates Social Security and Medicare. Imports data from Intuit QuickBooks, Microsoft Dynamics (GP or SL), Sage 50 (Peachtree), Sage DacEasy or CSV/ Excel. Efficient and intuitive manual W2 / 1099 data entry.

10 open-source alternatives for small business software

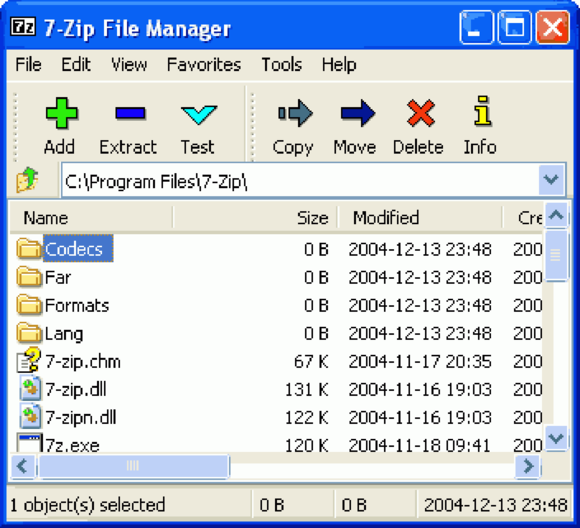

As an alternative, consider 7-Zip . It works with a broad range of compression formats, just like WinZip. It also offers 256-bit AES encryption, integration with Windows, and localization in 79 different languages. Desktop publishing: Scribus Many small and medium businesses also create their own marketing and advertising, designing brochures, fliers, and other content using a product like Microsoft Publisher.Like Outlook, Publisher is included with some of the pricier versions of Microsoft Office, or it can be purchased separately for $95. Scribus has all the tools you need to create professional-quality marketing materials. You can get the same page layout capabilities with Scribus . The open source software includes the tools you need to create professional-looking marketing materials, including press-ready output using color separations, CMYK and spot colors, and ICC color management. Invoicing: Simple Invoices No matter what business youre in, one of the most important functionsif not the most importantis getting paid. A lot of small businesses turn to services like Freshbooks to create professional, custom invoices to send to customers. The basic Freshbooks service is about $240 per year, though. Simple Invoices lets you handle all your billing from any Web browser. For an affordable alternative, take a look at Simple Invoices . This invoicing tool lets you track clients, manage recurring billing, adjust tax rates, and more. And Like Freshbooks, you can access it from any Web browser. Diagram creation: Dia If you need to create flowcharts or other visual diagrams, Microsoft Visio is a great tool to use. It will also cost you $250 per license. Dia lets you visualize complex information through flowcharts and diagrams. Instead, try Dia . Inspired by Visio, Dia includes a variety of tools and special objects to help create entity relationship diagrams, flowcharts, network diagrams, and more. It can also save diagrams in a variety of file formats, such as XML, EPS, WMF, SVG, PNG, and XFIG.

As an alternative, consider 7-Zip . It works with a broad range of compression formats, just like WinZip. It also offers 256-bit AES encryption, integration with Windows, and localization in 79 different languages. Desktop publishing: Scribus Many small and medium businesses also create their own marketing and advertising, designing brochures, fliers, and other content using a product like Microsoft Publisher.Like Outlook, Publisher is included with some of the pricier versions of Microsoft Office, or it can be purchased separately for $95. Scribus has all the tools you need to create professional-quality marketing materials. You can get the same page layout capabilities with Scribus . The open source software includes the tools you need to create professional-looking marketing materials, including press-ready output using color separations, CMYK and spot colors, and ICC color management. Invoicing: Simple Invoices No matter what business youre in, one of the most important functionsif not the most importantis getting paid. A lot of small businesses turn to services like Freshbooks to create professional, custom invoices to send to customers. The basic Freshbooks service is about $240 per year, though. Simple Invoices lets you handle all your billing from any Web browser. For an affordable alternative, take a look at Simple Invoices . This invoicing tool lets you track clients, manage recurring billing, adjust tax rates, and more. And Like Freshbooks, you can access it from any Web browser. Diagram creation: Dia If you need to create flowcharts or other visual diagrams, Microsoft Visio is a great tool to use. It will also cost you $250 per license. Dia lets you visualize complex information through flowcharts and diagrams. Instead, try Dia . Inspired by Visio, Dia includes a variety of tools and special objects to help create entity relationship diagrams, flowcharts, network diagrams, and more. It can also save diagrams in a variety of file formats, such as XML, EPS, WMF, SVG, PNG, and XFIG.

Friday, November 15, 2013

Amazon Changes The Big Data Game With Kinesis: Leaves Competition Speechless (for Now)

"Amazon Web Services (AWS) pretty much has the big data workload taken care of, said Wikibon analyst Jeff Kelly on theCUBE. Kinesis handles the real time processing of streaming data, Redshift handles traditional data warehousing, Elastic MapReduce (EMR) handles the open source Hadoop and DynamoDB serves as the database. theCUBES HOST, John Furrier asked, If they close the loop with Kinesis, who can take on Amazon? Who can provide social on top of the infrastructure? The answer? No other vendor can, at least at this point in time. When it comes to big data address manager free trial processing on the Cloud, only Microsoft with Azure, Google Cloud and maybe IBM come close, and thats overstating it. And when it comes to how Amazons ability to process big data streams in real-time affects the vendors that we think of when we hear the word Hadoop, we reached out to a good number of them and what we got back was pretty much silence. Though one did slip us some slides, with the condition that we do not reveal their identity (or publish the slides, of course). Is There a Downside to Processing Big Data on Amazons Cloud? The issues the slides brought up were around EMR, not Kinesis, but they included some relevant points about AWSs vulnerabilities when it comes to issues like: Security AWS policy reads Because youre building systems on top of the AWS cloud infrastructure, the security responsibilities will be shared: AWS manages the underlying infrastructure but you must secure anything you put on the infrastructure. Gravity Data needs to be moved to the Cloud then be extracted and made available to applications, analytics, the data warehouse . Limited Hadoop Components Amazons focus is on EMR. Costs While AWS is great for transient projects, the slides explain, on premises is less expensive when data is required to stay in the cloud, or cluster. The per minute costs of EMR in this scenario are infinite.

The per minute costs of EMR in this scenario are infinite. Will Established Enterprises Leap onto Amazons Cloud? Will these concerns keep enterprises from moving to Amazon? In some cases, yes.

Thursday, November 14, 2013

Uk Peer-to-peer Lender Funding Circle Expands With U.s. Deal

What Is Information Management Agility?

Oracle vs. SAP for procurement: Supplier Information Management

Analysis is good. Governance is groovy. But agility means action. Agility implies both the capacity and capability to act. Now. Immediately. Real-time. That doesn't mean the enterprise has to instantaneously act or react only that it has the power to do so. Schrage is not speaking ofagilityin terms of information management specifically, but what he says makes sense just the same: if information is our key asset, how can business software we use it to support our employees in making the right decisions?

Regardless of whether a company is running a consolidated Oracle back-end or a complicated, heterogeneous systems environment based on multiple ERPs, versions and instances, Oracle Supplier Hub can push and pull data in real-time from multiple systems. Supplier Hub can consolidate information from dozens of internal and potentially external source systems (and third-party enrichment data), create master-level supplier classification and mapping relationships, access cross-system information, synchronize and publish data, and apply data stewardship and governance approaches across hierarchies, tasks and overall classification.

Regardless of whether a company is running a consolidated Oracle back-end or a complicated, heterogeneous systems environment based on multiple ERPs, versions and instances, Oracle Supplier Hub can push and pull data in real-time from multiple systems. Supplier Hub can consolidate information from dozens of internal and potentially external source systems (and third-party enrichment data), create master-level supplier classification and mapping relationships, access cross-system information, synchronize and publish data, and apply data stewardship and governance approaches across hierarchies, tasks and overall classification.

Monday, November 11, 2013

Strategic Global Income Fund, Inc. -- Distribution Declaration And Updated Price & Distribution Rate Information

Further information regarding the estimated sources of the current regular monthly distribution will be provided around month-end; however, information provided will be an estimate and subject to change based on the Fund's investment experience during the remainder of its fiscal year. The Fund's Board receives recommendations from UBS Global Asset Management (Americas) Inc., the Fund's investment advisor, periodically and no less frequently than annually will reassess the annualized percentage of net assets at which the Fund's monthly distributions will be made. The Fund's Board may change or terminate the managed distribution policy at any time without prior notice to Fund shareholders; any such change or termination may have an adverse effect on the market price for the Fund's shares. To the extent that the Fund's taxable income in any fiscal year exceeds the aggregate amount distributed based on a fixed percentage of its net asset value, the Fund would make an additional distribution in the amount of that excess near the end of the fiscal year. To the extent that the aggregate amount distributed by the Fund based on a fixed percentage of its net asset value exceeds its current and accumulated undistributed earnings and profits, the amount of that excess would constitute a return of capital or net realized capital gains for tax purposes. A return of capital may occur, for example, when some or all of the money that shareholders invested in the Fund is deemed to be paid back to shareholders. A return of capital distribution does not necessarily reflect the Fund's investment performance and should not be confused with "yield" or "income." The Fund estimates the source characteristics of its monthly distributions.

Further information regarding the estimated sources of the current regular monthly distribution will be provided around month-end; however, information provided will be an estimate and subject to change based on the Fund's investment experience during the remainder of its fiscal year. The Fund's Board receives recommendations from UBS Global Asset Management (Americas) Inc., the Fund's investment advisor, periodically and no less frequently than annually will reassess the annualized percentage of net assets at which the Fund's monthly distributions will be made. The Fund's Board may change or terminate the managed distribution policy at any time without prior notice to Fund shareholders; any such change or termination may have an adverse effect on the market price for the Fund's shares. To the extent that the Fund's taxable income in any fiscal year exceeds the aggregate amount distributed based on a fixed percentage of its net asset value, the Fund would make an additional distribution in the amount of that excess near the end of the fiscal year. To the extent that the aggregate amount distributed by the Fund based on a fixed percentage of its net asset value exceeds its current and accumulated undistributed earnings and profits, the amount of that excess would constitute a return of capital or net realized capital gains for tax purposes. A return of capital may occur, for example, when some or all of the money that shareholders invested in the Fund is deemed to be paid back to shareholders. A return of capital distribution does not necessarily reflect the Fund's investment performance and should not be confused with "yield" or "income." The Fund estimates the source characteristics of its monthly distributions.

In an information economy: Information management must take center stage

People and information are the most valuable assets to any organization. However, recent studies show that enterprises are struggling to organize, manage, protect, retain and effectively use information. In their efforts to cost effectively manage information, businesses and governments are faced with five big challenges: 1. Exponential information growth -- Content is generated at an alarming rate as businesses grow and communicate faster and more frequently with increased connectivity and escalating use of mobile devices. Related Content Enterprises should improve information management practices 2. news Complicated hybrid infrastructures -- Most IT infrastructures are a complex mix of virtual, physical, hybrid and cloud components -- making it difficult to manage. 3. Escalating legal commitments and penalties -- Legal and discovery requirements continue to evolve, distracting executive management with potential fines, penalties, and even adverse publicity.

People and information are the most valuable assets to any organization. However, recent studies show that enterprises are struggling to organize, manage, protect, retain and effectively use information. In their efforts to cost effectively manage information, businesses and governments are faced with five big challenges: 1. Exponential information growth -- Content is generated at an alarming rate as businesses grow and communicate faster and more frequently with increased connectivity and escalating use of mobile devices. Related Content Enterprises should improve information management practices 2. news Complicated hybrid infrastructures -- Most IT infrastructures are a complex mix of virtual, physical, hybrid and cloud components -- making it difficult to manage. 3. Escalating legal commitments and penalties -- Legal and discovery requirements continue to evolve, distracting executive management with potential fines, penalties, and even adverse publicity.

Hooked On Candy Crush? King Gets Gameplayers To Pay

Saturday, November 9, 2013

Jpmorgan Chase Gains In Small Business Satisfaction Ranking

JPMorgan Chase gains in small business satisfaction ranking NEW YORK Wed Oct 30, 2013 12:20pm EDT Email Print A sign outside the headquarters of JP Morgan Chase & Co in New York, September 19, 2013. Credit: Reuters/Mike Segar NEW YORK (Reuters) - JPMorgan Chase & Co (JPM.N) ranked first in a small business customer satisfaction survey in three of four regions of the United States, a sharp improvement from 20th place nationally two years ago, research firm J.D. Power and said on Wednesday. The bank raised its ranking through changes to its customer service, which was previously slow to fix problems. Clients complained about having to deal with a different staff member every time they called the bank so JPMorgan assigned relationship managers to many customers, giving them a single point of contact, said Scott Geller, JPMorgan's chief executive for its small business unit. The top ranking may also have been because of a simpler factor, namely branch hours and locations, said Jim Miller, senior director of banking at J.D. Power. Small businesses still have a lot of cash and paper checks to deposit, so they need convenient branches, Miller said. He noted that in the Northeast, where JPMorgan ranked fifth, the bank that was first is the one that keeps its branches open for the most hours each week, Toronto-Dominion Bank's TD Bank. (TD.TO) JPMorgan has continued to spend money to add and remodel branches in recent years even as other banks have closed offices to cut costs and take advantage of customers doing more of their transactions with mobile devices. The bank, which lends to small businesses through its 5,600 Chase branches, ranked above other lenders in the Midwest, West and South, J.D. Power said. "A couple of years ago they were performing near the bottom," said Jim Miller, senior director of banking at J.D. Power. "They have made a dramatic improvement in a short time." JPMorgan's Geller said he is setting out to learn how TD Bank beat his bank in the Northeast in the survey. "We will give a good hard look at TD's results," Geller said. (Reporting by David Henry in New York. Editing by Dan Wilchins and Andrew Hay) FILED UNDER:

JPMorgan Chase gains in small business satisfaction ranking NEW YORK Wed Oct 30, 2013 12:20pm EDT Email Print A sign outside the headquarters of JP Morgan Chase & Co in New York, September 19, 2013. Credit: Reuters/Mike Segar NEW YORK (Reuters) - JPMorgan Chase & Co (JPM.N) ranked first in a small business customer satisfaction survey in three of four regions of the United States, a sharp improvement from 20th place nationally two years ago, research firm J.D. Power and said on Wednesday. The bank raised its ranking through changes to its customer service, which was previously slow to fix problems. Clients complained about having to deal with a different staff member every time they called the bank so JPMorgan assigned relationship managers to many customers, giving them a single point of contact, said Scott Geller, JPMorgan's chief executive for its small business unit. The top ranking may also have been because of a simpler factor, namely branch hours and locations, said Jim Miller, senior director of banking at J.D. Power. Small businesses still have a lot of cash and paper checks to deposit, so they need convenient branches, Miller said. He noted that in the Northeast, where JPMorgan ranked fifth, the bank that was first is the one that keeps its branches open for the most hours each week, Toronto-Dominion Bank's TD Bank. (TD.TO) JPMorgan has continued to spend money to add and remodel branches in recent years even as other banks have closed offices to cut costs and take advantage of customers doing more of their transactions with mobile devices. The bank, which lends to small businesses through its 5,600 Chase branches, ranked above other lenders in the Midwest, West and South, J.D. Power said. "A couple of years ago they were performing near the bottom," said Jim Miller, senior director of banking at J.D. Power. "They have made a dramatic improvement in a short time." JPMorgan's Geller said he is setting out to learn how TD Bank beat his bank in the Northeast in the survey. "We will give a good hard look at TD's results," Geller said. (Reporting by David Henry in New York. Editing by Dan Wilchins and Andrew Hay) FILED UNDER:

Small Businesses Remain Wary Of Hartford-area Economy's Future

Yet Hartford business owners though still generally cautious are hiring workers more often than small businesses are nationally. Connecticuts address software for small business small companies have adjusted to the new normal an extended period of average sub-par economic growth since the last recession ended three years ago, said Liam E. McGee, The Hartfords chief executive officer. Small firms have reset their expectations, he said, adding that many of these entrepreneurs still have deep scars from the Great Recession. They choose their clients with greater care and they hoard cash. Despite seven out of 10 businesses surveyed feeling their company operates successfully, a matching number said their risk-taking hiring workers, adding new products or services, investing in equipment hasnt changed over the past year. What we may be dealing with is a vicious cycle, McGee said, adding that while businesses are waiting for consumer demand to grow behind hiring more staff, consumers are holding onto their cash until the job market improves. But Malloy insisted there are reasons for Connecticuts small businesses to feel greater optimism about the future.

Thursday, November 7, 2013

Hooked On Candy Crush? King Gets Gameplayers To Pay

Redwood Software Celebrates 20 Years Of Automation With A Look To The Future

The back office revolution The impact of time-consuming, labour-intensive back office tasks has now moved to the forefront. Leading organisations will combine an industrial mind-set with new, faster strategic process automation to make back office work less tedious, risky and time-consuming for a definite competitive edge. 2. Manage the hybrid enterprise As use of the cloud and cloud-based services become the norm, the need for enterprises to manage and streamline their portfolio of services with a unified view will become paramount. Automation will connect cloud services, virtualised activities and on-site applications for comprehensive control and coordination.

The back office revolution The impact of time-consuming, labour-intensive back office tasks has now moved to the forefront. Leading organisations will combine an industrial mind-set with new, faster strategic process automation to make back office work less tedious, risky and time-consuming for a definite competitive edge. 2. Manage the hybrid enterprise As use of the cloud and cloud-based services become the norm, the need for enterprises to manage and streamline their portfolio of services with a unified view will become paramount. Automation will connect cloud services, virtualised activities and on-site applications for comprehensive control and coordination.

Software Company Anahata Offers Services to Melbourne's Internet Publishing Industry

Visit small business address book software the official Anahata website http://www.anahata-it.com.au and get more information and further details about the companys ICT solutions customized for the internet publishing industry. About Founded in 2010 by Robert Nagajek and Pablo Rodriguez Pina , Anahata Technologies Pty Ltd is an Australian privately owned software company specializing in the analysis, design, implementation and support of cost-effective, custom built software applications. Since 2013, Anahata Technologies offers software development and consultancy services in Melbourne (Victoria) Joana Lopez Castrillo was anointed Regional Manager for Victoria. Anahatas preferred delivery approach is an iterative, customer centric software development process where business analysts visit customer premises to gather requirements, outline the current business processes and design an improved flow.

Visit small business address book software the official Anahata website http://www.anahata-it.com.au and get more information and further details about the companys ICT solutions customized for the internet publishing industry. About Founded in 2010 by Robert Nagajek and Pablo Rodriguez Pina , Anahata Technologies Pty Ltd is an Australian privately owned software company specializing in the analysis, design, implementation and support of cost-effective, custom built software applications. Since 2013, Anahata Technologies offers software development and consultancy services in Melbourne (Victoria) Joana Lopez Castrillo was anointed Regional Manager for Victoria. Anahatas preferred delivery approach is an iterative, customer centric software development process where business analysts visit customer premises to gather requirements, outline the current business processes and design an improved flow.

Monday, November 4, 2013

Grave Digger To Gold Digger: Singapore Business Shifts Feed Governance Worries

Grave digger to gold digger: Singapore business shifts feed governance worries By Anshuman Daga SINGAPORE | Thu Oct 10, 2013 9:25pm EDT SINGAPORE (Reuters) - A funeral parlor switches into gold mining; a steel trader turns into a property developer; and a food packaging firm ventures into resources. Reverse takeovers and shifting corporate business strategies on Singapore's stock market have come under the spotlight in the wake of a recent collapse in the share prices of three companies listed on Southeast Asia's biggest bourse. One of the companies, Blumont Group Ltd (BLUM.SI), lost as much as S$6.2 billion ($4.96 billion) in market value in the past week. Prior to that, Blumont had surged as much as 12-fold this year, making it Singapore's top performer. The company, which listed in mid-2000, has shifted its focus between investment - most recently in mining companies - property development and sterilized food and medicine packaging. The changes in business operations and the use of reverse takeovers - where a private firm buys a public company usually to bypass an often lengthy listing process - and its impact on the broader market risk undermining the credibility of one of Asia's biggest financial and regulation centers. "It's one thing to change businesses like that if you're a closed-end investment fund, but if it's a listed company and it keeps chopping and changing then that raises all sorts of governance concerns because as a minority shareholder you don't then know what you're a shareholder of," said Jamie Allen, secretary general of the Asian Corporate Governance Association. The market operator, Singapore Exchange Ltd (SGX) (SGXL.SI), had already toughened its listing rules after a string of blow-ups at locally-listed Chinese stocks, known as S-chips, in 2008 and 2011. At the same time, it has seen few big-ticket listings. The metamorphosis of a handful of small Singapore companies, mostly penny stocks, has made them among the most actively traded on the SGX, which is home to blue chips such as Singapore Airlines Ltd (SIAL.SI) and DBS Group Holdings Ltd (DBSM.SI). The market has seen sharp gains in small stocks. As of last week, many of the top 10 performers this year, with gains of 200-900 percent, had started new businesses or said they were exploring such forays. The SGX queried most of these companies on the price surge. "Sometimes, these things (new ventures) can go either way for the smaller investors," said Jimmy Ho, president of the Society of Remisiers (Singapore). "It's better if the relevant authorities can do adequate due diligence beforehand." The SGX pointed to guidelines saying all listings must comply with the prospectus disclosure requirements in the Securities Futures Act and the requirements of its listing rules. The exchange says it considers a reverse takeover in the same way it would an initial public offering in terms of how it scrutinizes the proposal from a regulatory perspective. GRAVES TO GOLD As part of one reverse takeover, Asia Pacific Strategic Investments Ltd (APST.SI), a funeral services provider in Malaysia, is transforming into a mining company with assets in Armenia. A new investor is buying a 30 percent stake in the restructured firm for S$200 million, implying a total value of S$667 million. Previously, the company had a market value of about S$10 million. "We have been making losses for the last 3-4 years. So the company has been looking for a new business or new life," said Chief Financial Officer Lee Keng Mun. "We believe this gold mine is a profitable business project." Manufacturing businesses seem hardest hit. "The operating environment is very difficult for a lot of traditional businesses, but the owners are not keen to give up their listing," said Kevin Scully, founder and executive chairman of equity research firm NRA Capital. "The listing has value and that's why you see a flux of people coming to do reverse takeovers." Facing a dwindling outlook in its manufacturing business, ICP Ltd (ICPL.SI) bought a majority stake in two tanker-owning entities earlier this year after previously investing in a coal exploration asset in Australia. This week, it proposed an investment in an unlisted Australian gold miner. Similarly, Courage Marine Group Ltd (CRMG.SI), a dry bulk shipper, in June proposed diversifying into property investment, noting that its core business of transporting sand, cement and gravel helped it build up a network of construction industry contacts, and it had approaches to invest in real estate. TRADING CURBS Broker UOB Kay Hian last week imposed trading limits on many small cap stocks which it reckoned were over-valued after a sharp run-up in prices. Those included Blumont, Asiasons Capital Ltd (ASNS.SI) and LionGold Corp Ltd (LION.SI) - the three inter-linked stocks that fell sharply in recent sessions. Wild price swings in smaller stocks are fairly routine in a free market that has no circuit breakers. The SGX has opened public consultations on proposed circuit breakers for the securities market and plans to introduce these by the year-end. "In other markets, if a stock price jumps 20 percent in one trading session, you'll probably call a trading halt and then find out what happened," said NRA Capital's Scully. In a rare move, the SGX suspended trading in Blumont, Asiasons and LionGold on Friday after the sharp price falls, and later declared them as "designated securities" - meaning investors cannot short-sell them and buyers must pay upfront in cash. Trading later resumed, but under certain conditions. Last year, Britain's financial regulator proposed reforms of its listing rules to close loopholes allowing reverse takeovers, in a bid to better protect investors. SGX's dual role as market operator and regulator has in the past raised questions about a conflict of interest as it regulates listed companies that are also its clients. "The question is whether they are able to regulate and profit from the market at the same time, which seems to be impossible," said Ho at the Society of Remisiers. In a letter to the Straits Times newspaper on Wednesday, one reader wrote: "Why did the Singapore Exchange, as the regulator, not step in earlier to calm penny stock trading when prices rose from a few cents to more than S$2?" "It was left to the broking houses to assume the role of regulator and impose trading curbs." ($1 = 1.2509 Singapore dollars)

Grave digger to gold digger: Singapore business shifts feed governance worries By Anshuman Daga SINGAPORE | Thu Oct 10, 2013 9:25pm EDT SINGAPORE (Reuters) - A funeral parlor switches into gold mining; a steel trader turns into a property developer; and a food packaging firm ventures into resources. Reverse takeovers and shifting corporate business strategies on Singapore's stock market have come under the spotlight in the wake of a recent collapse in the share prices of three companies listed on Southeast Asia's biggest bourse. One of the companies, Blumont Group Ltd (BLUM.SI), lost as much as S$6.2 billion ($4.96 billion) in market value in the past week. Prior to that, Blumont had surged as much as 12-fold this year, making it Singapore's top performer. The company, which listed in mid-2000, has shifted its focus between investment - most recently in mining companies - property development and sterilized food and medicine packaging. The changes in business operations and the use of reverse takeovers - where a private firm buys a public company usually to bypass an often lengthy listing process - and its impact on the broader market risk undermining the credibility of one of Asia's biggest financial and regulation centers. "It's one thing to change businesses like that if you're a closed-end investment fund, but if it's a listed company and it keeps chopping and changing then that raises all sorts of governance concerns because as a minority shareholder you don't then know what you're a shareholder of," said Jamie Allen, secretary general of the Asian Corporate Governance Association. The market operator, Singapore Exchange Ltd (SGX) (SGXL.SI), had already toughened its listing rules after a string of blow-ups at locally-listed Chinese stocks, known as S-chips, in 2008 and 2011. At the same time, it has seen few big-ticket listings. The metamorphosis of a handful of small Singapore companies, mostly penny stocks, has made them among the most actively traded on the SGX, which is home to blue chips such as Singapore Airlines Ltd (SIAL.SI) and DBS Group Holdings Ltd (DBSM.SI). The market has seen sharp gains in small stocks. As of last week, many of the top 10 performers this year, with gains of 200-900 percent, had started new businesses or said they were exploring such forays. The SGX queried most of these companies on the price surge. "Sometimes, these things (new ventures) can go either way for the smaller investors," said Jimmy Ho, president of the Society of Remisiers (Singapore). "It's better if the relevant authorities can do adequate due diligence beforehand." The SGX pointed to guidelines saying all listings must comply with the prospectus disclosure requirements in the Securities Futures Act and the requirements of its listing rules. The exchange says it considers a reverse takeover in the same way it would an initial public offering in terms of how it scrutinizes the proposal from a regulatory perspective. GRAVES TO GOLD As part of one reverse takeover, Asia Pacific Strategic Investments Ltd (APST.SI), a funeral services provider in Malaysia, is transforming into a mining company with assets in Armenia. A new investor is buying a 30 percent stake in the restructured firm for S$200 million, implying a total value of S$667 million. Previously, the company had a market value of about S$10 million. "We have been making losses for the last 3-4 years. So the company has been looking for a new business or new life," said Chief Financial Officer Lee Keng Mun. "We believe this gold mine is a profitable business project." Manufacturing businesses seem hardest hit. "The operating environment is very difficult for a lot of traditional businesses, but the owners are not keen to give up their listing," said Kevin Scully, founder and executive chairman of equity research firm NRA Capital. "The listing has value and that's why you see a flux of people coming to do reverse takeovers." Facing a dwindling outlook in its manufacturing business, ICP Ltd (ICPL.SI) bought a majority stake in two tanker-owning entities earlier this year after previously investing in a coal exploration asset in Australia. This week, it proposed an investment in an unlisted Australian gold miner. Similarly, Courage Marine Group Ltd (CRMG.SI), a dry bulk shipper, in June proposed diversifying into property investment, noting that its core business of transporting sand, cement and gravel helped it build up a network of construction industry contacts, and it had approaches to invest in real estate. TRADING CURBS Broker UOB Kay Hian last week imposed trading limits on many small cap stocks which it reckoned were over-valued after a sharp run-up in prices. Those included Blumont, Asiasons Capital Ltd (ASNS.SI) and LionGold Corp Ltd (LION.SI) - the three inter-linked stocks that fell sharply in recent sessions. Wild price swings in smaller stocks are fairly routine in a free market that has no circuit breakers. The SGX has opened public consultations on proposed circuit breakers for the securities market and plans to introduce these by the year-end. "In other markets, if a stock price jumps 20 percent in one trading session, you'll probably call a trading halt and then find out what happened," said NRA Capital's Scully. In a rare move, the SGX suspended trading in Blumont, Asiasons and LionGold on Friday after the sharp price falls, and later declared them as "designated securities" - meaning investors cannot short-sell them and buyers must pay upfront in cash. Trading later resumed, but under certain conditions. Last year, Britain's financial regulator proposed reforms of its listing rules to close loopholes allowing reverse takeovers, in a bid to better protect investors. SGX's dual role as market operator and regulator has in the past raised questions about a conflict of interest as it regulates listed companies that are also its clients. "The question is whether they are able to regulate and profit from the market at the same time, which seems to be impossible," said Ho at the Society of Remisiers. In a letter to the Straits Times newspaper on Wednesday, one reader wrote: "Why did the Singapore Exchange, as the regulator, not step in earlier to calm penny stock trading when prices rose from a few cents to more than S$2?" "It was left to the broking houses to assume the role of regulator and impose trading curbs." ($1 = 1.2509 Singapore dollars)

16 Surprising Small Business Statistics (infographic)

On Black Friday, most people go to big stores that offer the best deals, like Best Buy, Walmart, etc. But some people wait one more day to do their holiday shopping so that they can support small, local businesses. Well, we really love small businesses and the fact that theres a day to celebrate them thats officially recognized by the U.S. Senate. Since its not until the very end of the month, we have a bit of counting down to do. While we try to give small business as many resources as we can via our blog and social media channels , were amping it up a bit this month. Well be posting content thats specific to small businesses more often, and branching out in the type of advice and resources we provide them. As a way to introduce this countdown to the blog, we thought wed start off with a great infographic from Docstoc with a few great numbers about visit site small business: The Small Business Administration defines a small business as an enterprise with fewer than 500 employees. ( Tweet this stat ) There are almost 28 million small businesses in the U.S.

On Black Friday, most people go to big stores that offer the best deals, like Best Buy, Walmart, etc. But some people wait one more day to do their holiday shopping so that they can support small, local businesses. Well, we really love small businesses and the fact that theres a day to celebrate them thats officially recognized by the U.S. Senate. Since its not until the very end of the month, we have a bit of counting down to do. While we try to give small business as many resources as we can via our blog and social media channels , were amping it up a bit this month. Well be posting content thats specific to small businesses more often, and branching out in the type of advice and resources we provide them. As a way to introduce this countdown to the blog, we thought wed start off with a great infographic from Docstoc with a few great numbers about visit site small business: The Small Business Administration defines a small business as an enterprise with fewer than 500 employees. ( Tweet this stat ) There are almost 28 million small businesses in the U.S.

Survey: Small Businesses Frustrated with Congress

Prior to the partial government shutdown, just over 40% of business owners said they expected their fourth quarter to be better than their third quarter. Now, just 27% are feeling as positively in this regard. Overall optimism also took a dip to 62%, falling ten percentage points from July. Southern States Show Strength Looking at hiring and employee pay, southern states are coming out on top. While hiring stayed flat in the South month-over-month, it decreased slightly in every other region, with the nationwide average landing at negative 0.1%. Additionally, the South was the only region that saw employee pay per check on the rise, growing 0.2%; nationally, employee pay stayed flat. And when it comes to employee pay by city, Southern cities are leading the charge, with Texas metro areas showing particularly strong results.

Prior to the partial government shutdown, just over 40% of business owners said they expected their fourth quarter to be better than their third quarter. Now, just 27% are feeling as positively in this regard. Overall optimism also took a dip to 62%, falling ten percentage points from July. Southern States Show Strength Looking at hiring and employee pay, southern states are coming out on top. While hiring stayed flat in the South month-over-month, it decreased slightly in every other region, with the nationwide average landing at negative 0.1%. Additionally, the South was the only region that saw employee pay per check on the rise, growing 0.2%; nationally, employee pay stayed flat. And when it comes to employee pay by city, Southern cities are leading the charge, with Texas metro areas showing particularly strong results.

Friday, November 1, 2013

Jpmorgan Chase Gains In Small Business Satisfaction Ranking

Genpact Optimizes Scripps Health Hospital Coding And Health Information Management (him) Operations

Genpact used its Lean Six Sigma process reengineering expertise along with health information management (HIM) and coding expertise to standardize coding and operational processes for improved efficiencies, helping Scripps Health meet regulatory requirements. "Healthcare systems like Scripps Health are seeking ways to improve our workflows and information management for faster coding and billing and efficient patient processes that support optimal care all while adhering to regulatory changes like ICD-10," said Jean business software Fuller, assistant vice president, Health Information Services, Scripps Health. "Genpact is applying its process excellence and healthcare expertise to help us achieve this operational effectiveness and regulatory compliance so that we can focus on our core business of providing excellent patient care." "Genpact will help Scripps Health execute smarter coding processes and significantly improved document workflow," said Mohit Thukral, senior vice president, Banking, Financial Services, Insurance and Healthcare, Genpact. "As one of the very few companies providing global delivery of inpatient, outpatient and emergency department coding services, Genpact is honored to leverage our business process transformation expertise so that Scripps Health can achieve the business impact of increased productivity, decreased account receivables, cost savings and efficient operations needed to thrive in the current healthcare environment." About Scripps Health Scripps Health is a private, nonprofit, integrated health system in San Diego, California that treats a half-million patients annually at facilities that include five acute-care hospital campuses.

Genpact used its Lean Six Sigma process reengineering expertise along with health information management (HIM) and coding expertise to standardize coding and operational processes for improved efficiencies, helping Scripps Health meet regulatory requirements. "Healthcare systems like Scripps Health are seeking ways to improve our workflows and information management for faster coding and billing and efficient patient processes that support optimal care all while adhering to regulatory changes like ICD-10," said Jean business software Fuller, assistant vice president, Health Information Services, Scripps Health. "Genpact is applying its process excellence and healthcare expertise to help us achieve this operational effectiveness and regulatory compliance so that we can focus on our core business of providing excellent patient care." "Genpact will help Scripps Health execute smarter coding processes and significantly improved document workflow," said Mohit Thukral, senior vice president, Banking, Financial Services, Insurance and Healthcare, Genpact. "As one of the very few companies providing global delivery of inpatient, outpatient and emergency department coding services, Genpact is honored to leverage our business process transformation expertise so that Scripps Health can achieve the business impact of increased productivity, decreased account receivables, cost savings and efficient operations needed to thrive in the current healthcare environment." About Scripps Health Scripps Health is a private, nonprofit, integrated health system in San Diego, California that treats a half-million patients annually at facilities that include five acute-care hospital campuses.